As a NFT specialist at Platinum Crypto Academy, I’ve been closely following the latest developments in the NFT market, particularly the recent surge in Bitcoin-based NFTs. Let me share my insights on a significant event that has caught the attention of the NFT community.

The Shadows NFT Mint: A Major Milestone in Bitcoin NFTs

The NFT space recently witnessed a remarkable event with the Shadows NFT mint on the Bitcoin network. The Shadows NFT collection, created by Dotta and the Forgotten Runes team, achieved a staggering success, raising over $5.5 million by selling just 600 NFTs in less than two hours. This event is not just a success story for the team but a promising sign for the NFT market on Bitcoin.

Breaking Down the Shadows NFT Mint

The Shadows NFT mint was structured as a 24-hour ascending auction,

with a minimum bid of 1 satoshi and a maximum bid of 0.2 BTC, termed a “goated” bid. Participants who placed a goated bid were entered into a raffle for a Shadow Hat NFT, a unique and coveted item within the collection. The allure of this raffle ticket was enough to drive the market to max bid quickly, with all 600 bids at the maximum price received within the first 1.5 hours of the auction.

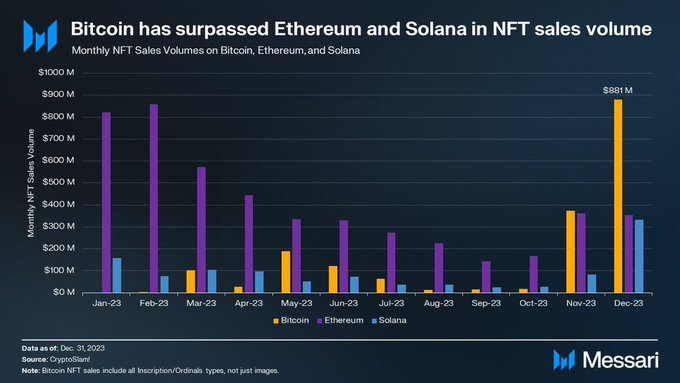

This rapid sell-out is a testament to the growing interest and value placed on Bitcoin-based NFTs. It’s a significant indicator of the market’s readiness to embrace NFTs on blockchains beyond Ethereum, which has traditionally dominated the NFT space.

Innovative Auction Strategy

The Shadows team employed a unique auction strategy that played a significant role in their success. The 24-hour ascending auction format, with a minimum bid of 1 satoshi and a maximum “goated” bid of 0.2 BTC, created an intense and competitive bidding environment. The inclusion of the Shadow Hat NFT raffle for goated bid participants added an extra layer of incentive, driving the market to reach the maximum bid quickly.

THE SHADOWS WILL BE CLAIMABLE IN ABOUT TWO HOURS

Shadows: you will be able to claim on Magic Eden here: https://t.co/8NG5Db1WZF

This includes all 600 Goated Bids.

We are working on adding the 66 free items to the claim.

— Shadow Hats (@theshadowhats) January 15, 2024

Early Adoption and Market Timing

Timing and early adoption were key factors in the Shadows’ success. The team’s decision to mint during the initial surge of interest in Bitcoin-based NFTs, particularly when the Ordinals project was gaining traction, positioned them advantageously in the market. By capitalizing on the novelty and burgeoning interest in Bitcoin NFTs, Shadows managed to capture the attention of collectors and investors who were eager to explore new opportunities beyond the Ethereum ecosystem.

Building on Existing Success

The Shadows project wasn’t the team’s first foray into the NFT world. Their previous project, Forgotten Wizards, had already established a community and reputation within the NFT space. This prior success and recognition provided a solid foundation for the Shadows mint, ensuring a ready and eager audience.

Community Engagement and Lore

The Shadows team also excelled in engaging their community and building an intriguing lore around their collection. The parent-child relationship feature, unique to Bitcoin NFTs, added a novel aspect to the Shadows collection, making it more than just a set of digital assets. This storytelling and community engagement fostered a sense of belonging and excitement among potential buyers, contributing to the rapid sell-out.

The Impact on the Broader Ordinals Market

The success of the Shadows mint had a noticeable impact on the broader Ordinals market as well. Prior to the mint, leading collections like NodeMonkes and Bitcoin Puppets had been experiencing a downturn in volume. However, post-mint, these collections saw a rebound, suggesting a renewed interest and confidence in the market.

This event also highlights the unique capabilities of Bitcoin for NFTs, particularly the parent-child relationship feature utilized in the Shadows project. This feature, currently exclusive to Bitcoin, adds a new layer of complexity and intrigue to NFTs, potentially opening up new avenues for creativity and innovation in the space.

My Perspective as a NFT Specialist

As a NFT specialist, I view the Shadows mint as a pivotal moment in the evolution of the NFT market. It demonstrates the viability and potential of Bitcoin as a platform for NFTs, challenging the Ethereum-centric view of the market. The success of this mint could pave the way for more creators and investors to explore Bitcoin NFTs, potentially leading to a more diverse and vibrant NFT ecosystem.

Ethereum NFT Market Dynamics

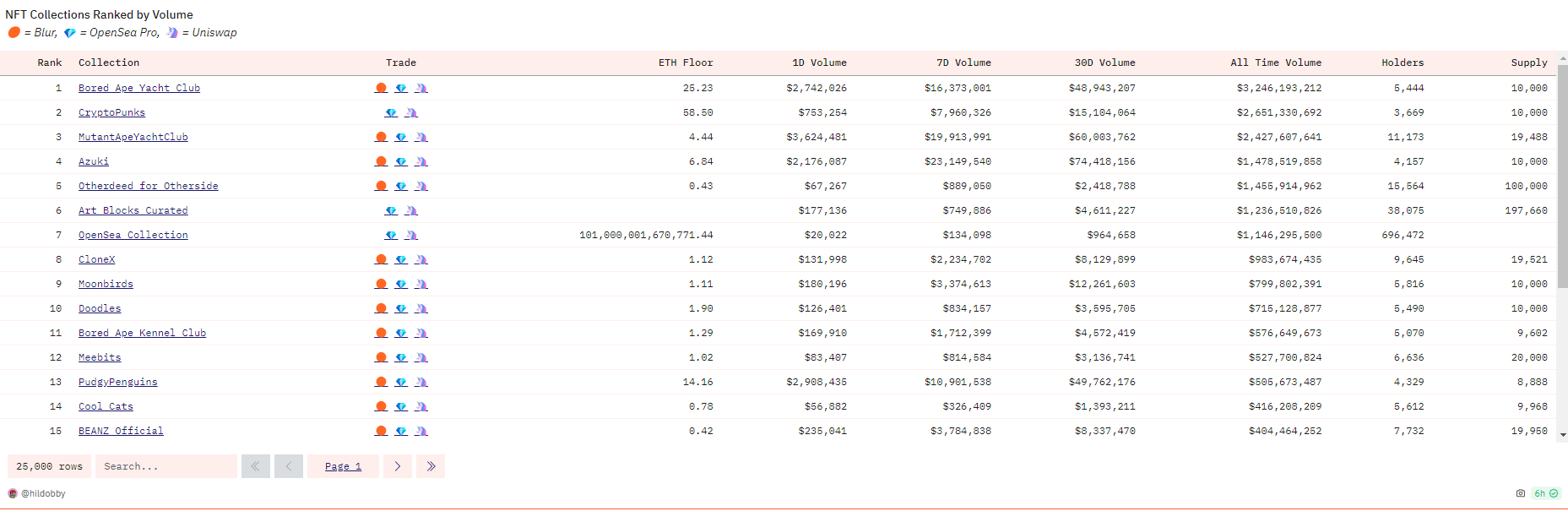

- ETH Trading Volume Surge: The Ethereum NFT market saw a substantial increase in trading volume, jumping to $32.7 million on Thursday. This surge was primarily driven by significant activity on OpenSea and notable sales in the CryptoPunks collection. Despite this uptick in volume, the overall sentiment in the market was bearish, with most NFT leaders recording red numbers.

- Azuki and MAYC Price Movements: Azuki continued to lead in volume but experienced a 7% drop in floor price, settling at 6.4 ETH. Meanwhile, Mutant Ape Yacht Club (MAYC) found a new local low at 3.85 ETH, marking an 8% decrease. Bored Ape Yacht Club (BAYC) managed to hold its ground, remaining steady at a floor price of 23 ETH.

Significant Whale Activity

- Whale’s Impact on Punks and Squiggles: A new whale made a major debut in the market, sweeping 13 CryptoPunks and 18 Squiggles. This significant acquisition led to a 14% increase in the floor price of Squiggles, reaching 8.69 ETH, and a 4% rise in CryptoPunks, pushing their floor price to 58 ETH.

Bitcoin NFT Market and New Projects

- Node Monkes and New Entrants: In the Bitcoin NFT space, Node Monkes led the trading but experienced a dip below 0.15 BTC before rebounding to 0.185 BTC. A new project, Persona by Rapture, made its debut with a floor price rallying to 0.15 BTC but later fell to 0.094 BTC.

- The Golden Ratio’s Milestone: The Bitcoin generative art collection, The Golden Ratio, surpassed all 2023 Art Blocks sets in floor price, currently standing at 0.16 BTC or 2.75 ETH.

Solana NFT Market Trends

- Open Solmap’s Remarkable Growth: On the Solana platform, Open Solmap led the trading with a significant 39% jump to 0.46 SOL. However, other collections like Froganas and Saga Monkes continued their downtrend, priced at 4.15 and 5.8 SOL respectively. Mad Lads and Tensorians also saw notable trading activity, with prices at 177 and 97 SOL.

Innovative Projects and Developments

- Taproot Wizards and KILLABEARS: Taproot Wizards unveiled “Quantum Cats,” adding intrigue to their recent inscriptions. KILLABEARS released “The Hunt,” a sequel to its previous short film featuring Seth Green as an Executive Producer, although the NFT floor price fell by 6% to 0.9 ETH.

- Wasabi Protocol’s New Season: Wasabi Protocol announced the launch of its Season 2, running for three months with a points program rewarding trading, liquidity provision, and social sharing. This follows their successful first week, where they achieved over $2 million in perpetual volume.

- LooksRare’s Interactive Game on Arbitrum: LooksRare launched “Poke the Bear” on Arbitrum, an interactive game where players poke a bear and risk elimination if the bear wakes up. The remaining players split the remaining fees, adding a gamified element to the NFT trading experience.

Bitcoin ETFs Day 1 Report: A Roller Coaster in the Markets

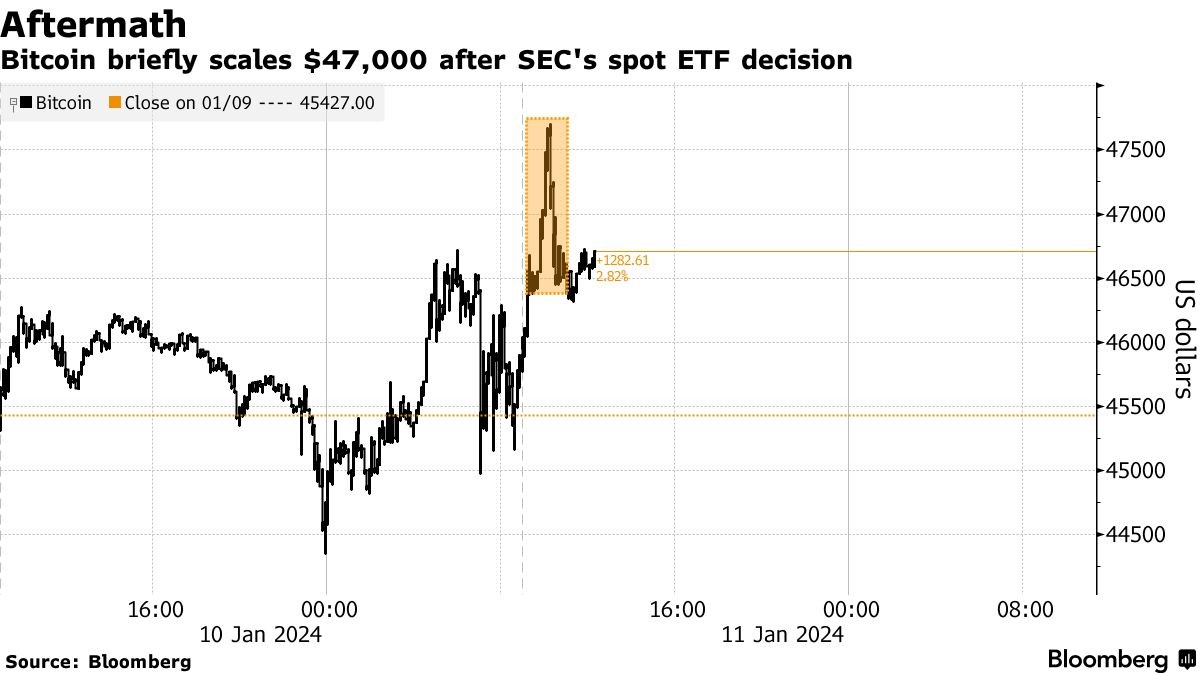

As a NFT specialist and keen observer of cryptocurrency trends at Platinum Crypto Academy, I closely followed the launch of Bitcoin ETFs, which marked a significant day in the history of cryptocurrency. The first day of trading for these ETFs was nothing short of a roller coaster, reflecting the volatile nature of the crypto market. Here’s my take on the events of that day:

Initial Surge and Subsequent Reversal

The day started with a surge of optimism as Bitcoin (BTC) prices pumped hard, briefly surpassing the $49,000 mark in the first 30 minutes of market open. This initial excitement was indicative of the high expectations and enthusiasm surrounding the ETF launch. However, the euphoria was short-lived. The prices abruptly reversed, falling to around $46,000, where they mostly stabilized. This sudden shift highlighted the market’s sensitivity to new developments and the inherent unpredictability of cryptocurrency trading.

Record-Breaking Trading Volume

Despite the price volatility, the group of Bitcoin ETFs witnessed a combined trading volume of $4.3 billion on the first day, setting a record for ETF launches. This high volume of trading underscored the significant interest and participation from investors, both retail and institutional, in the cryptocurrency space. It was a clear indication that, despite the price fluctuations, there was a strong demand and belief in the potential of Bitcoin and related financial products.

Mixed Reactions and Regulatory Feedback

The day was not without its challenges. Vanguard blocked its clients from purchasing the BTC ETFs on day one, and there were mixed reactions regarding the role outflows from GBTC played in this scenario. Additionally, prominent figures like Elizabeth Warren expressed their concerns, stating that the SEC made a mistake with the decision. These reactions reflect the ongoing debate and regulatory uncertainty surrounding cryptocurrencies and related financial products.

The first day of Bitcoin ETFs trading was a landmark event, marked by high enthusiasm, significant trading volumes, and notable price volatility. As a professional in the crypto space, I view this as a pivotal moment that underscores both the opportunities and challenges within the cryptocurrency market. It highlights the growing mainstream acceptance of cryptocurrencies, while also reminding us of the need for cautious and informed trading strategies in this rapidly evolving market.

At Platinum Crypto Academy, we continue to monitor these developments closely, providing our clients with up-to-date insights and guidance on navigating.

the complexities of the cryptocurrency market. The launch of Bitcoin ETFs is a step towards greater institutional involvement in crypto, potentially paving the way for more stability and growth in the long term. However, it also serves as a reminder of the market’s volatility and the importance of regulatory clarity in shaping the future of cryptocurrency investments.

The recent events in the cryptocurrency and NFT markets are indicative of a maturing digital asset space that is increasingly complex and interconnected. The launch of Bitcoin ETFs, the success of the Shadows NFT mint, and the ongoing developments in the NFT market represent the multifaceted nature of this domain. As a specialist at Platinum Crypto Academy, I believe these developments offer valuable insights for investors and enthusiasts alike. They underscore the importance of staying informed and agile in a market characterized by rapid innovation and change. The future of digital assets continues to be promising, filled with opportunities for growth, diversification, and strategic investment.