For those who remain skeptical, grasping why individuals are willing to shell out hundreds of thousands of dollars for a mere cartoon JPEG or invest significant time on Discord pursuing whitelist spots can be perplexing.

In response, we urge skeptics to broaden their perspective and delve into the underlying value and potential of NFTs.

NFTs have unlocked the concept of digital ownership, marking a pivotal shift from Web 2.0 (a read-write economy) to Web 3.0 (a read-write-own economy). As society increasingly immerses itself in screen-centric activities, the ability to authenticate the scarcity of digital assets for the first time holds the promise of catalyzing a fundamental transition from physical to digital ownership.

In this segment, we will examine the latest developments in the NFT market, fundraising endeavors, and emerging trends within the sector.

Within the metaverse, NFTs harbor considerable potential. They serve as a means to denote asset ownership, establish scarcity, and monetize content. While certain challenges remain, such as delineating ownership representation and curbing inflationary pressures, numerous initiatives are already underway to address these issues. If these hurdles can be surmounted, NFTs stand poised to exert a profound influence on the trajectory of virtual realms.

NFT Market Trends

Despite experiencing a notable decline in trading volume during June, the NFT market demonstrated resilience throughout the first half of 2023. The year began on a strong note for NFTs, with trading activity seeing a surge, driven by the launch of the LooksRare and X2Y2 marketplaces, along with the trading rewards they offered.

In 2023, NFT sales totaled approximately $17.7 billion, a figure comparable to the sales recorded in 2021. This represents a remarkable nearly tenfold increase when compared to the previous year.

However, the bulk of trading volume was concentrated in the earlier months, with a significant portion of sales occurring during this period. June saw a sharp decline in trading volume, dropping by over 80% compared to the average monthly trading volume of $3.4 billion from January to May.

A closer examination of the underlying factors reveals that the resilient performance in the first half of the year was bolstered by healthy growth in terms of unique buyers and the number of transactions, albeit offset by a decline in the average sale price.

This decline in average sale price can be attributed to the downward trend observed in cryptocurrency prices over the past few months, resulting in lower NFT sale prices when denominated in USD.

The Metaverse NFT market pertains to the buying and selling of non-fungible tokens within virtual worlds or immersive digital environments. This market has garnered significant attention recently due to the rising interest in the Metaverse, which refers to a shared virtual space that blends elements of the physical and digital realms.

According to a report by Market Research Future (MRFR), the NFT market is poised to surpass USD 342.54 billion by 2032, with a projected Compound Annual Growth Rate (CAGR) of 27.6% by 2032. This growth is fueled by increasing global demand for digital art and the widespread adoption of cryptocurrency.

The global Metaverse Market is poised for steady growth over the projected period, with a Compound Annual Growth Rate (CAGR) of 47.2% expected from 2023 to 2027. This growth trajectory is forecasted to elevate the industry spending value from $61.8 billion in 2022 to approximately $426.9 billion by the conclusion of 2027.

The Metaverse NFT market encompasses a wide range of digital assets, including virtual real estate, avatars, artwork, and virtual fashion. The expansion of this market is fueled by several growth drivers, including the increasing adoption of blockchain technology, the surging popularity of gaming and virtual environments, and the rising demand for unique and scarce digital assets.

Furthermore, the Metaverse NFT market offers novel opportunities for creators, artists, and gamers to monetize their digital creations. It also provides investors with avenues to diversify their portfolios by investing in these distinctive assets.

NFT Price Performance

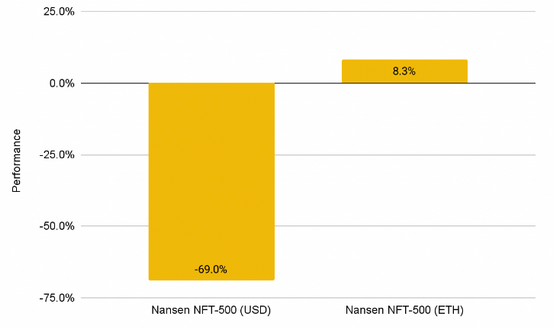

Year-to-date, NFTs have experienced a negative performance when measured in USD terms, primarily attributed to a decline in ETH prices. To track broad market activity, our analysis utilizes the Nansen NFT-500 index, which comprises the top 500 Ethereum NFT collections weighted by market capitalization.

While the Nansen NFT-500 index provides valuable insights, it’s essential to acknowledge its limitations as it does not encompass all NFT collections, particularly those not based on Ethereum. However, Ethereum-based NFTs dominate the market, accounting for over 80% of secondary trading volume, making the index a reliable barometer of the NFT market.

The NFT-500 index has recorded a -69% return in USD terms, primarily driven by a 71% decline in ETH prices during the same period. However, when isolating the effects of the ETH price decline, the asset class has exhibited a +8.3% return when denominated in ETH.

This performance is significant, especially amid the overall bearish market sentiment. Investing in NFTs instead of holding ETH would have partially offset portfolio losses, highlighting the potential diversification benefits of NFT investments.

NFTs: Unique Digital Assets

In the digital realm, perfect copies of entities can typically be made effortlessly. However, NFTs, or non-fungible tokens, stand apart as one-of-a-kind digital items. Each NFT is uniquely tied to the blockchain, ensuring its authenticity and uniqueness.

NFTs find applications across various crypto projects, showcasing their versatility. For instance, Decentraland, a metaverse virtual world, features a thriving industry centered around NFT land sales. Similarly, Axie Infinity integrates virtual animals as unique NFTs, allowing users to nurture or trade them within the game ecosystem.

NFT performance exhibited negativity when measured in USD terms but displayed positivity when denominated in ETH.

The positive performance in ETH terms could have been driven by optimistic investor sentiment stemming from specific NFT-related events in the latter half of June, such as the NFT.NYC conference, alongside notable acquisitions and fundraising activities. Prior to these events, the NFT index had been in negative territory but began to gain traction towards the end of the month.

NFT Marketplaces

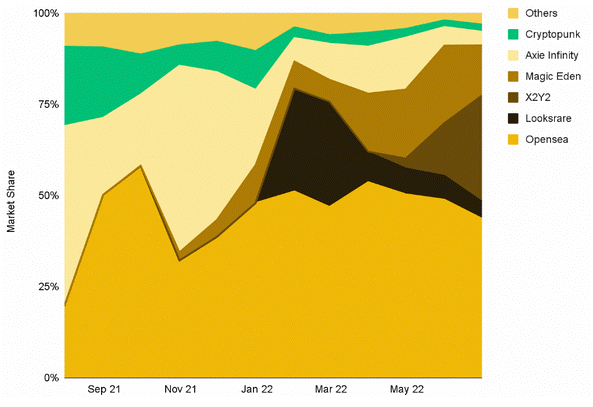

NFT marketplaces play a crucial role in facilitating trading activities by linking buyers and sellers. OpenSea continues to lead the NFT marketplace in terms of trading volume, commanding approximately 50% of the market share.

Although OpenSea has maintained its dominance over the past year, the market has become increasingly competitive. New players like LooksRare, X2Y2, and Magic Eden have demonstrated strong performance, challenging the status quo.

The market share of NFT marketplaces highlights OpenSea as the primary leader, yet X2Y2 emerges as a formidable competitor.

The Emergence of NFT Aggregators

Between 2022 and 2023, NFT aggregators emerged as a notable trend, providing traders with the ability to buy and sell NFTs across multiple marketplaces through a single platform, akin to the functionality offered by Skyscanner for flights. This feature aligns well with general trading behaviors.

For the majority of NFT traders, platform preference is secondary to securing their desired NFT at the best possible price. Consequently, NFT aggregators capitalize on this behavior by consolidating listings from various marketplaces and presenting them in a unified interface.

Moreover, NFT aggregators offer added value by enabling traders to efficiently browse collections by purchasing the lowest-priced NFTs without the need to navigate through individual marketplaces.

Leading aggregators such as Gem and Genie have experienced substantial growth, boasting a combined trading volume of over 511,000 ETH in the current year alone. This represents a remarkable 21-fold increase compared to the figures recorded in 2021.

Additionally, the market share of NFT aggregators has expanded significantly from just over 1% at the close of 2021 to approximately 5% at present. It’s important to note that these percentages are based on end-of-month data snapshots, which may fluctuate depending on trading activity on any given day.

While the market share of NFT aggregators remains modest, recent acquisitions such as Gem by OpenSea and Genie by Uniswap underscore the considerable interest that industry leaders have in NFT aggregators. These acquisitions also validate the value proposition offered by NFT aggregators, indicating their potential to play a pivotal role in shaping the NFT trading ecosystem in the long term.

The appeal of using NFT aggregators is likely to increase as competition intensifies among NFT marketplaces and liquidity becomes more fragmented. With the convenience of accessing multiple marketplaces and finding the best-priced NFTs through a single platform, users may find greater incentive to adopt NFT aggregators. However, widespread adoption of these platforms may take some time to materialize, as many NFT listings currently originate from a handful of marketplaces such as OpenSea, X2Y2, and LooksRare. As a result, traders may still find it manageable to check one or two exchanges before making a trade.

Looking ahead, the NFT market is poised for significant transformations in 2024, with several emerging trends expected to shape its trajectory.

Below are some of the notable trends and advancements shaping the NFT landscape:

Metaverse Integration:

NFTs are poised to play a central role in the Metaverse, with increasing adoption for virtual real estate and in-game assets. Collaborations between NFT creators and Metaverse platforms will redefine digital interactions, offering immersive experiences that bridge the physical and virtual realms.

Dynamic NFTs:

Beyond static images, the trend is shifting towards dynamic NFTs that evolve over time, featuring changing visuals, adaptive functionalities, and evolving narratives. This dynamic nature enhances engagement and fosters a more participatory ecosystem.

Social Tokenization:

Creators and influencers are tokenizing their presence, granting exclusive content, experiences, and even governance rights to their communities. Social tokens empower creators to cultivate loyal followings while allowing fans to have a stake in their favorite projects.

AI-Generated NFTs:

Artificial intelligence is expected to play a significant role in NFT creation, with machine creativity producing unique digital assets. This fusion of human creativity and AI innovation will give rise to innovative digital art pieces.

Cross-Chain NFTs:

Interoperability will be emphasized, with cross-chain NFTs enabling seamless movement of digital assets across different blockchain networks. This interoperability enhances liquidity and expands market accessibility.

Environmental Consciousness:

The NFT community is increasingly prioritizing eco-friendly solutions, focusing on blockchain technologies with reduced energy consumption and carbon footprints.

AR and VR Enhancements:

Augmented and virtual reality technologies will be integrated with NFTs, providing collectors with immersive experiences to interact with their digital assets in both real-world and virtual settings.

Marketplaces and Aggregators:

NFT marketplaces, both traditional and white-label, are attracting attention from businesses and investors as lucrative platforms for revenue generation and brand visibility.

Fractional NFTs:

Subdivided tokens aim to broaden user participation and facilitate fund redistribution across various assets, drawing inspiration from shared ownership models in real estate and stocks.

NFT Memberships:

NFTs are utilized for memberships, offering exclusive access, voting rights, and enhanced user experiences through blockchain security.

NFT Gaming:

NFTs have revolutionized the gaming industry by introducing unique methods to convey ownership and scarcity of in-game assets.

Layer-2 NFT Solutions:

Addressing network congestion challenges, these solutions built atop Layer-1 blockchains enhance scalability, security, and reduce transaction costs.

Carbon Credit NFTs:

Representing an innovative approach to environmental sustainability, these NFTs verify offsetting carbon emissions and are gaining traction for their role in demonstrating environmental impact mitigation.

Wrap Up

In conclusion, the NFT market is undergoing significant transformations in 2024, driven by advancements in technology and evolving consumer preferences. From the integration of NFTs into the Metaverse to the rise of dynamic and AI-generated NFTs, the landscape is evolving rapidly. Additionally, the emphasis on environmental sustainability, interoperability, and enhanced user experiences is reshaping the way NFTs are created, traded, and utilized.

As NFTs continue to gain traction across various industries, including gaming, art, and social media, it is clear that they are here to stay. The emergence of new trends such as cross-chain NFTs, social tokenization, and layer-2 solutions underscores the potential for further innovation and growth in the market.

Overall, the dynamic nature of the NFT market in 2024 presents opportunities for creators, investors, and consumers alike. By staying abreast of these trends and embracing the possibilities offered by NFT technology, stakeholders can position themselves to thrive in this rapidly evolving landscape.