Short-term price actions are based largely on sentiment and less on long-term value. Therefore, in a bear market, every negative news acts as a catalyst for more selling. Bitcoin and several altcoins fell on the news that Weibo has blocked accounts of “Key Opinion Leaders” which many believe is a sign of increased crackdown on cryptocurrencies by China.

United States Treasury Secretary Janet Yellen said in an interview with Bloomberg that inflation and interest rates have been too low for a decade. Hence, if they moved up after the recent $4 trillion package announced by President Joe Biden, then “that’s not a bad thing — that’s a good thing.”

OUR BLOG ARTICLES FOR THIS SPECIAL ISSUE ARE

ROOCOIN – THE DONATION ECOSYSTEM BASED ON CRYPTOCURRENCY!,

STARTER – DECENTRALIZED FUNDRAISING, MULTICHAIN ECOSYSTEM,

&

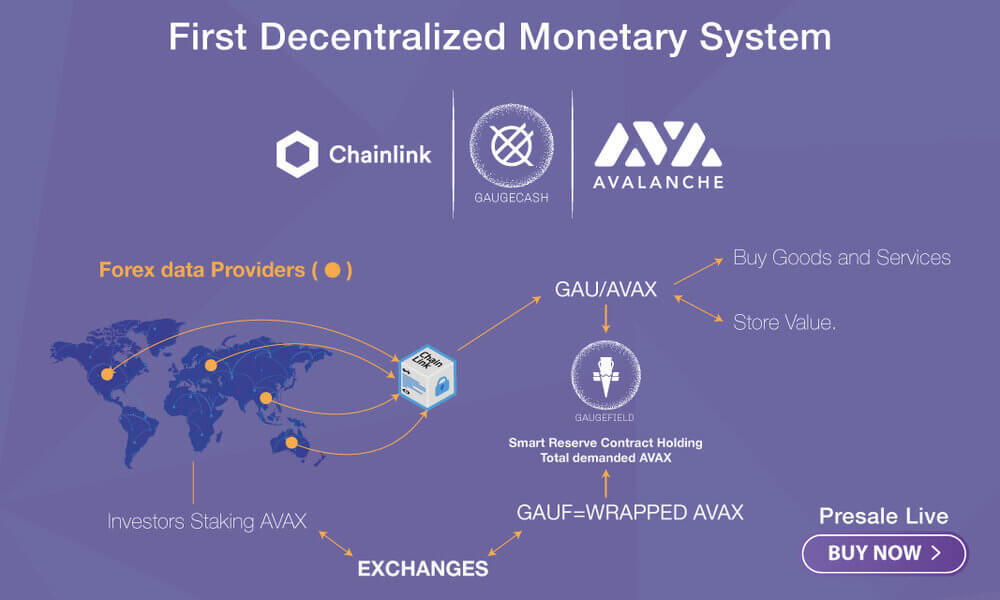

GAUGECASH – THE WORLD’S FIRST DECENTRALIZED MONETARY SYSTEM

Bitcoin turned down from the 20-day exponential moving average (EMA) on June 4, suggesting the bears are aggressively defending this resistance. The downsloping moving averages and the relative strength index (RSI) near the oversold territory indicate the bears are in control.

The BTC/GBP pair has broken below the critical support at £23,620 today. This opens the door for a drop to the £21,000 to £20,000 support zone. The bulls are likely to defend this zone aggressively. The buyers will have to push and sustain the price above the 20-day EMA to indicate a possible change in trend. Until then, every rally is likely to be met with strong selling pressure from the bears.

Aggressive traders may buy 40% of the desired allocation if the price bounces off £21,000. This trade should not be attempted on the way down but only on a rebound. This is a risky counter-trend trade, hence, traders may keep a close stop-loss to protect their positions because if the £20,000 level cracks, the decline could extend to £15,000.

Lastly please check out the advancement’s happening in the cryptocurrency world.

Enjoy the issue!

FEATURING IN THIS WEEKS EDITION

– Asia Broadband

– Gaugecash

– RooCoin

– Starter

– Somee

– iZOBi

– Ledger

CRYPTO TRADE OPPORTUNITIES

BITCOIN – BTC/GBP

Bitcoin turned down from the 20-day exponential moving average (EMA) on June 4, suggesting the bears are aggressively defending this resistance. The downsloping moving averages and the relative strength index (RSI) near the oversold territory indicate the bears are in control. The BTC/GBP pair has broken below the critical support at £23,620 today. This opens the door for a drop to the £21,000 to £20,000 support zone. The bulls are likely to defend this zone aggressively. The buyers will have to push and sustain the price above the 20-day EMA to indicate a possible change in trend. Until then, every rally is likely to be met with strong selling pressure from the bears. Read more

ETHEREUM – ETH/GBP

We had recommended traders to buy on a breakout and close above the 50-day simple moving average (SMA) but the trade did not trigger. Ether turned down from just below the 50-day SMA on June 4. The bulls again tried to push the price above the 20-day EMA on June 5 and 7 but the long wick on the day’s candlestick suggests selling at higher levels. The bears will now try to sink the price below the support line of the triangle. Read more

RIPPLE – XRP/GBP

XRP turned down from the 20-day EMA on June 4, suggesting the sentiment remains negative and traders are selling on rallies to this resistance. The XRP/GBP pair could drop to £0.53566, which is likely to act as a strong support. However, a break below this level could clear the path for a further fall to £0.46167 and then to the support line of the descending channel. The downsloping moving averages and the RSI in the negative territory indicate the bears are in command.. Read more

CARDANO – LTC/GBP

Cardano broke above the downtrend line on June 3, triggering the buy recommendation given in the previous analysis. However, we had also warned to close positions if the price failed to rise higher after breaking above the downtrend line as that could be a bull trap. That is what happened on June 4 as the price plunged back below the downtrend line. Traders who followed our advice would have closed their position with a nominal loss. In trading, it is important to keep the losses small when the market does not behave according to our expectations. Read more

BINANCE – BNB/GBP

Binance Coin rose above £282 on June 2, triggering our buy suggested in the previous analysis. However, the up-move stalled at £305.44 on June 3 and the price turned down. Traders who kept a close stop-loss could have gotten out of the trade at breakeven or with a minor loss. The price turned down from the 20-day EMA on June 7 and the BNB/GBP pair could now drop to the next support at £200. If this support also cracks, the decline could extend to the critical support zone at £160 to £150.74. Read more

Subscribe to latest crypto news digital magazine for the latest updates about profit and loss in cryptocurrency.

ASIA BROADBAND (AABBG): THE 100% GOLD-BACKED TOKEN FROM A US MINING COMPANY

KOJI Intro

Asia Broadband Inc. (OTC: AABB) is pleased to announce its recent alliance with Platinum Crypto Academy and Cryptonaire Weekly Magazine to share news of their recent crypto-related products. AABB is US-based resource company focused on the production, supply, and sale of precious and base metals primarily to the Asian markets. In March 2021, the company recently launched their gold-backed crypto, the AABB Gold token, along with their AABB Wallet. Read more

IZOBI – A MARKETPLACE CONNECTING SERVICE PROVIDERS WITH HOMEOWNERS

iZOBi, an innovative marketplace that connects freelance service providers, homeowners and other users, recently appointed Platinum Crypto Academy and Cryptonaire Weekly to further its platform and mission. With this appointment, Platinum Crypto Academy will provide all the crypto users with recent updates and information about the iZOBi platform. Read more

ETHEREUM AND XRP LOOKING MORE ATTRACTIVE AS INVESTORS RUSH TO EXIT BITCOIN FUNDS

Investors redeemed a net $141 million during the seven days through June 4, the highest weekly total on record, according to CoinShares.

Bitcoin-focused investment funds suffered record redemptions by investors last week after May’s price drop soured sentiment on the largest cryptocurrency by market value. Investors redeemed a net $141 million from bitcoin (BTC, -8.78%) funds during the seven days through June 4, the highest weekly total on record, according to the report from CoinShares, a digital-asset manager. The amount represents about 8.3% of net inflows recorded earlier in the year. In May, most digital asset funds experienced net outflows when the bitcoin price suffered a near 30% correction. Read more

CRYPTO MARKETS TUMBLE AFTER MINERS UNLOAD 5,000 BTC IN ONE WEEK

With Bitcoin’s price consistently trending below its 200-day moving averages and heavy selling identified among miners, some analysts are bracing for further bearish momentum. The crypto markets are against dropping, with Bitcoin crashing below $33,000 for the first time since May 23 as Ethereum similarly broke below support at $2,500. The downward momentum comes as bearish indicators continue to stack up for Bitcoin, with popular analyst William Clemente III identifying that miners sold more than 5,000 BTC over the past week — worth roughly $164 million at current prices. Read more

MICHAEL SAYLOR LAUNCHES MACROSTRATEGY SUBSIDIARY TO HOLD BITCOIN, RAISING $400M DEBT TO BUY MORE BTC

Michael Saylor’s publicly listed analytics and business intelligence company wants to add more Bitcoin to its coffers which already holds approximately 92,079 BTC. Interestingly, these BTC will be held by a newly formed subsidiary, MacroStrategy LLC. With this announcement, the company also shared that they will be raising yet another $400 million in a private offering to qualified institutional buyers by issuing senior secured notes due 2028. Read more

ANONYMOUS TARGETS ELON MUSK FOR DESTROYING CRYPTO HOLDERS’ LIVES, TRYING TO CONTROL BITCOIN

The decentralized group Anonymous has published a message for Elon Musk in a video where they called the Tesla CEO “nothing more than another narcissistic rich dude who is desperate for attention.” They shed light on many things people may not know about Musk, including how he treats his employees, harms the environment, where his fortune came from, how Tesla actually makes money, and his attempt to centralize and control bitcoin mining. Read more

ETHEREUM GAS PRICES FALL BELOW $1—HERE’S TWO REASONS WHY

GAS prices fell to the lowest in months. Here’s two leading factors for the drop.

According to Etherscan, Ethereum’s average gas price has dropped to under $1.

Less than one month ago, as ETH’s price rose to an all-time high, gas prices were over $50. Read more

$7.5 BILLION HEDGE FUND SEES ‘MORE UPSIDE’ IN HOLDING BITCOIN THAN GOLD

According to a $7.5 billion hedge fund, the price of gold will hit fresh highs in the next year, but investors may be better off gaining exposure to bitcoin instead as there’s “more upside” in holding the cryptocurrency. During an interview with Bloomberg Troy Gayeski, co-chief investment officer and senior portfolio manager at SkyBridge Capital, a hedge fund with $7.5 billion under management, said the fund will maintain its exposure to the flagship cryptocurrency in the near future. Gayeski was quoted saying: Read more

ROOCOIN – THE DONATION ECOSYSTEM BASED ON CRYPTOCURRENCY!

RooCoin – A number of charities accept digital cryptocurrencies as donations in todays article we will explore advantages of utalising cryptocurrencies for fundraising. There is no doubt that there has been an increase in the amount of cryptocurrency investment globally. The growth of cryptocurrency has penetrated charity fundraising events. Cryptocurrencies are part of a crypto ecosystem; a collection of elements in which these elements interact with one another and the environment around them to create a unique environment. Read more

STARTER – DECENTRALIZED, MULTICHAIN ECOSYSTEM

Investing in cryptocurrencies and fundraising on crypto launchpads is evolving at such a rapid pace that you’ll want to read this article to get up to speed as well as learn how to get involved with the fastest growing launchpad-turning ecosystem, Starter. Crypto launchpads are a way for new ventures, or projects, to collect funds while also giving investors early access to token sales. Typically, this results in lower prices for tokens before they reach the market. “Starter” (formerly known as a BSCstarter) is a community-run, decentralized platform for raising funds in a safe, secure and cost-effective manner. Read more

GAUGECASH – THE WORLD’S FIRST DECENTRALIZED MONETARY SYSTEM

The decentralized monetary system is probably the biggest incident in the world of financial technology and monetary policy. The ownership of any wealth is transferred without the involvement of a third party using a bank-free method. Decentralized finance, mostly known as DeFi, is an umbrella term for a wide range of projects and applications in the blockchain world that opt to eliminate traditional finance theory. Read more