The Russia-Ukraine conflict attracted strong economic sanctions by the West, sending the Russian ruble (RUB) tumbling to a record low of 118 per dollar on February 28, according to Bloomberg data.

This resulted in a massive increase in Bitcoin trading volumes in the Russian ruble as investors sought to protect their wealth from the plummeting ruble. “Volume for both RUB and Ukrainian hryvnia (UAH) trading pairs increased far more quickly than volume for other pairs, such as BTCUSD, which suggests the crisis is directly influencing trading behaviour,” said crypto data company Kaiko, CNBC reported.

The Russia-Ukraine conflict has underlined the importance of cryptocurrencies, which are borderless and censorshipresistant.

We had mentioned in our previous analysis that Bitcoin could slide to £25,000 and the price dipped to £25,414.38 on February 24. The subsequent rally rose to the 50-day simple moving average (SMA) but the bears defended the level aggressively. The BTC/GBP pair turned down on February 26 but strong buying on February 28 propelled the price above the 50-day SMA. The rally has reached the strong resistance zone of £32,382 to £34,031.

This zone has acted as a strong resistance on three previous occasions, hence the bears are again expected to mount a strong defence. If the price turns down from this zone, the pair could drop to the 50-day SMA. A sharp bounce off the 50-day SMA could offer a buying opportunity to traders as that will suggest that sentiment has turned positive and traders are buying on dips.

If buyers drive the pair above the overhead zone, the next stop could be the 200-day SMA. This positive view will be invalidated if the price turns down from the current level and breaks below the 50-day SMA. Such a move will indicate that the pair remains range-bound between £24,450 and £34,032.

Lastly please check out the advancement’s happening in the cryptocurrency world.

Enjoy the issue!

FEATURING IN THIS WEEKS EDITION

– Hubble Protocol

– XMateFans

– The Boujee Leopards Club

– Reefer Token

– Nunu Spirits

– Mine Network

– Jimizz

– Faith Tribe

CRYPTO TRADE OPPORTUNITIES

BITCOIN – BTC/GBP

We had mentioned in our previous analysis that Bitcoin could slide to £25,000 and the price dipped to £25,414.38 on February 24. The subsequent rally rose to the 50-day simple moving average (SMA) but the bears defended the level aggressively.

The BTC/GBP pair turned down on February 26 but strong buying on February 28 propelled the price above the 50-day SMA. The rally has reached the strong resistance zone of £32,382 to £34,031. Read more

ETHEREUM – ETH/GBP

We had suggested that Ether is likely to find strong buying support near £1,732 and that is what happened. The ETH/GBP pair bounced off £1,704.91 on February 24, indicating accumulation at lower levels.

The bears stalled the recovery at the 50-day SMA on February 26 but the bull broke above the barrier on February 28. The pair could now rise to the resistance line of the triangle where the bears may mount a stiff resistance. Read more

RIPPLE – XRP/GBP

XRP dipped to £0.46 on February 24, close to our projected support zone of £0.43 to £0.40. The XRP/GBP pair rose above the 50-day SMA on February 25 but turned back from the downtrend line on February 26.

A minor positive is that the bulls defended the 50-day SMA and the price bounced off this level on February 28. This indicates that the sentiment remains positive and traders are buying on dips. Read more

CARDANO – ADA/GBP

Cardano remains in a strong downtrend. The bulls purchased the dip to the support line of the descending channel on February 24 and the buyers are trying to push the ADA/GBP pair to the 50-day SMA. This level is likely to attract strong selling by the bears.

If the price turns down from the 50-day SMA, it will suggest that bears continue to sell on rallies. However, if bulls do not give up much ground from the 50-day SMA, it will increase the possibility of a break above the level. Read more

BINANCE – BNB/GBP

We said in our previous analysis that traders will aggressively defend £247 and that is how it played out. Binance Coin dipped below £247 but this move proved to be a bear trap.

The price quickly turned around and bounced sharply, indicating strong demand at lower levels. The BNB/GBP pair has reached the 50-day SMA, which is again acting as a strong resistance. Read more

Subscribe to the latest crypto news digital magazine for the latest updates about profit and loss in cryptocurrency.

NFT MARKET SUMMARY

The year 2022 began with quite a few launches of NFTs projects in January and the momentum is continuing in February too. The fact that most of the projects have long term vision as far as their existence and sustainability is concerned, shows that the existing players are quite bullish about the future of NFTs.

One reason for the bullishness could be the spike in trading volumes that we saw in December after a period of declining volumes in the preceding few months. That being said, it is a long way ahead before NFTs are considered at par with other mainstream asset classes. Here are the key recent developments in the NFT space

DeFi Coming to Solana with Hubble Protocol

Solana came into the picture back in March 2020. Since then, it has skyrocketed both in usage and in price. Despite the network outages that many incorrectly assumed to be the death of Solana, the network has continued to soar higher and stronger. Solana’s native token (SOL) has risen significantly since January 2021, signalling a huge interest in the Solana network by the market. As of September 2021, the total value locked in Solana DeFi protocols amounted to $12 billion. While this is nowhere near the humongous $120 billion locked in Ethereum, it is a start and good progress in the right direction. One of the most recent developments in the network is the Hubble Protocol. This project will help bring DeFi to Solana in a massive way. Read more

Jacquie & Michel Group officially launches its own crypto-currency: the Jimizz

MINE Network: The best GameFi dApp based on hashrate!

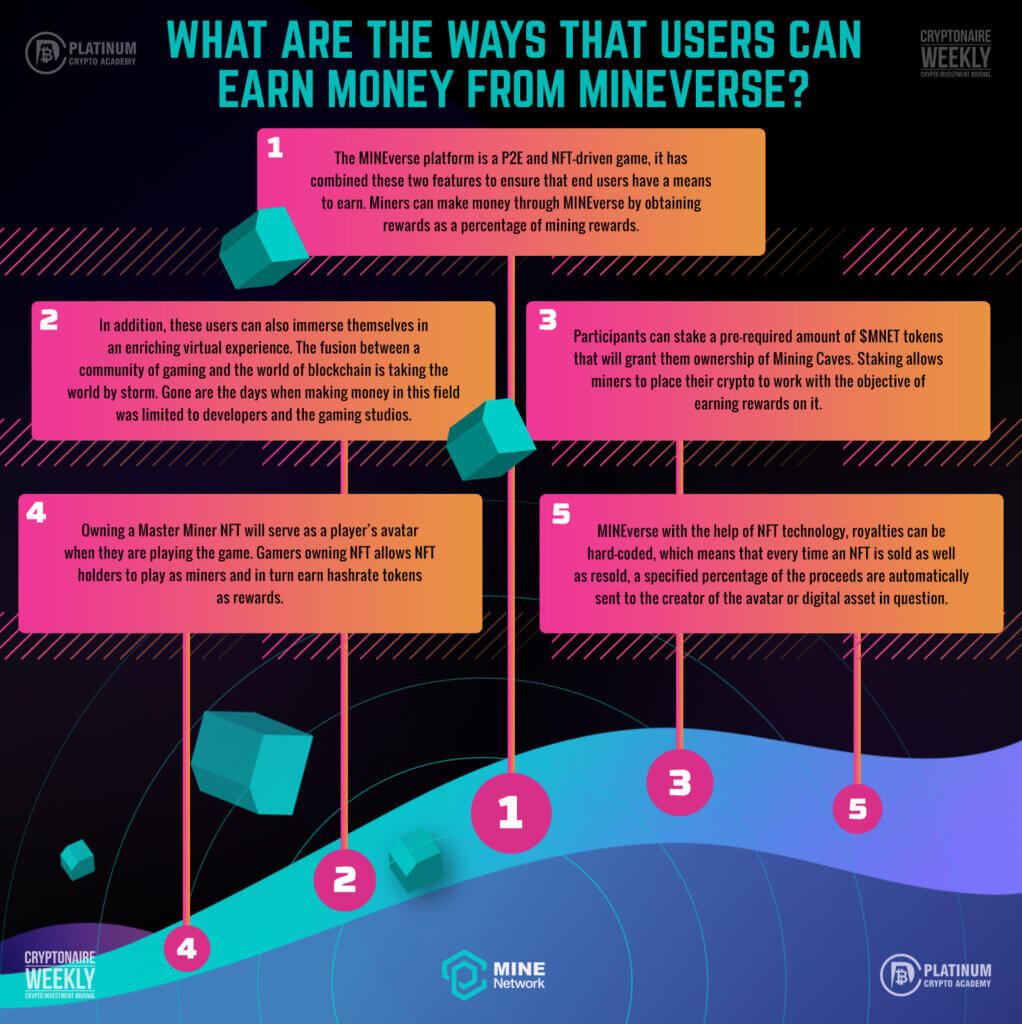

The gaming industry has evolved into something that is more than just entertainment. Thanks to blockchain technology, gamers are now able to both entertain themselves and earn revenue through tokenization. As a result of combining games, Decentralised Finance (DeFi) and Non-fungible Tokens (NFTs), GameFi projects have created a boom in not only users but also in token prices. Overall, GameFi is a type of game that launches their own tokens. These tokens serve two main purposes, such as being used to reward players and for trading in-game items between a player and another. Gamers can in turn swap their tokens for other cryptocurrencies or for fiat money in exchanges. Read more

REEFER Token Sells Out Pre-Sale Allotment Ahead of Schedule

The revolutionary crypto cannabis platform was set to end its pre-sale on February 24th

LOS ANGELES, California (Feb 22nd, 2022) (MARKETWIRE) – REEFER Token (https://reefertoken.io/) ($REEFER), the revolutionary crypto platform for the cannabis industry has has sold it its pre-sale 3 days earlier, which was slated to end on February 24th. REEFER Token expects to publicly list on Pancake Swap early next week. In advance of listing, REEFER Token will engage in an aggressive, targeted, and intensive marketing & promotional campaign that will include Instagram/Twitter influencers, Telegram AMA’s, call groups, and listings on influential coin sites such as (coinmarketcap.com) and (coingecko.com) Because of the early sell out, the REEFER Token founding team had to reschedule a number of promotional initiatives planned. Check REEFER’s Telegram chat here for details in advance of the public listing. Read more

Hubble Protocol: Now Live on Solana

Hubble Protocol is now LIVE on the Solana Mainnet, as of the 31st of January, allowing individuals to mint and deposit USDH as well as stake their HBB.

After providing the knowledge on how to use Hubble, users can now take on the next step on the platform where USDH has entered the greater Solana system. Read more

The Petroyuan Is No Russia Sanctions Buster; Bitcoin 15% Gain Is Largest in a Year as Investors See Opportunity for Crypto

Good morning. Here’s what’s happening: Markets: Bitcoin, ether and other major cryptos rise, even as the U.S. looked to hamstring Russian from using crypto to evade sanctions. Insights: CBDCs won’t help Russia evade economic sanctions. Technician’s take: BTC’s 11% price jump reflects short-term bullish activity, although upside appears limited

Institutions Pour $36,000,000 Into Bitcoin, Ethereum and One Additional Altcoin As Market Volatility Skyrock- ets: CoinShares

Digital asset manager CoinShares says institutional investment in crypto assets hit $36 million last week as Russia’s invasion of Ukraine rocked global markets. In the latest Digital Asset Fund Flows Weekly report, Coinshares says institutional inflows from the Americas canceled out last week’s European outflows. “Digital asset investment products saw inflows totaling US$36m last week despite the ongoing turmoil in Eastern Europe and the anticipated negative sentiment. Interestingly, volumes in Bitcoin crypto exchanges that trade the RUB/USD pair have

Ukraine has re- ceived $37M in tracked crypto do- nations so far

Developers from Polkadot and VeChain have put an additional $13M on the table as well. Based on data gathered by Cointelegraph, the amount of tracked crypto donations sent to the Ukrainian government, military and charities has surpassed $37 million at the time of publication. These include Bitcoin (BTC), Ether (ETH), Tether (USDT) and other altcoins. The numbers are also based on tracked projects and do not account for items such as donation efforts between individuals

Canada-based Bitcoin ETF Sees Surge In Demand Amid Unrest

Despite the price of Bitcoin falling, demand for Bitcoin ETFs remains strong. The Purpose Bitcoin ETF (BTCC), located in Canada, has reached an all-time high in terms of holdings. The Purpose Bitcoin ETF, which was the world’s first spot-settled Bitcoin ETF, presently has 32,329 Bitcoins.

Chainlink Adds Bahrain Telco to Roster of Big-Name Node Operators

Crypto-friendly stc Bahrain will launch a Chainlink node, joining Deutsche Telekom and Swisscom. A subsidiary of Saudi Telecom Company (stc) is the first telecommunications firm in the Middle East and North Africa (MENA) region to start working with crypto infrastructure firm Chainlink.

Virtual Cosmetics Are Now A Thing As L’Oreal Enters The Metaverse

At this point, everything that can conceptually be moved to the metaverse has been moved. This includes clothing, gaming, general daily living, and now L’Oreal is moving cosmetics to the metaverse. It is the first to do this as it files multiple patents that will allow the cosmetics giant to provide virtual variations of its products for use in this budding space. L’Oreal Enters Metaverse L’Oreal is the latest of many fashion and beauty brands that have begun making their marks in the metaverse. Following its predecessors, the cosmetics giant has filed a number of trademarks that will mark its entry into the space. A total of 17 trademarks was filed with the World Intellectual Property