Navigating the dynamic landscape of the crypto market while venturing into purchasing USD Coin (USDC) within the United States presents both opportunities and challenges, especially for those new to the realm of cryptocurrency investment.

Nevertheless, it’s crucial to recognize that acquiring the USDC cryptocurrency is not only entirely legal but also accessible within the United States. However, ensuring a smooth and secure crypto journey requires a comprehensive understanding of the intricacies involved before diving in headfirst.

Is the United States crypto-friendly?

Despite boasting a substantial user base in the cryptocurrency realm, the United States currently lacks clear-cut regulations specifically tailored to the purchase of USDC and other digital currencies. However, it’s important to note that buying and holding USDC, along with other cryptocurrencies, has never been expressly prohibited within the country.

The Internal Revenue Service (IRS), the federal tax agency in the United States, categorizes USDC, along with other stablecoins and cryptocurrencies, as property. As such, taxpayers are provided with guidelines outlining how these assets should be treated from a tax perspective.

In the United States, acquiring USDC through a cryptocurrency exchange involves a structured two-step process. Initially, individuals must undergo Know Your Customer (KYC) verification, which entails providing identification and address proof to comply with Anti-Money Laundering and Countering the Financing of Terrorism (AML/CTF) regulations. Subsequently, there are restrictions on purchase amounts over time to prevent market manipulation and uphold financial stability.

USD Coin (USDC) was conceived as a regulated stablecoin, designed to adhere to U.S. money transmission laws and subject to oversight by U.S. financial authorities. Despite occasional periods of depegging, USDC’s core principle of maintaining a 1:1 peg with the U.S. dollar ensures stability, rendering it a transparent and legally compliant stablecoin.

What motivates individuals to purchase USDC in the United States?

Understanding the process of acquiring USDC within the U.S. necessitates recognizing the significance of stablecoins in payment systems. Stablecoins, including Tether (USDT), USD Coin (USDC), and Dai, offer the stability and liquidity required for various financial activities such as remittances and trading.

USD Coin (USDC) stands out among other stablecoins, such as USDT and DAI, by virtue of its robust regulatory compliance measures and transparency mechanisms. These mechanisms encompass regular audits and public disclosures of reserves, which instill a higher level of transparency compared to alternative stablecoins.

Traders and investors often gravitate towards USDC in pursuit of stability within the volatile cryptocurrency market. Its straightforward purchasing process and strict adherence to U.S. pegging standards ensure a dependable valuation, making it a preferred choice for those prioritizing stability in their investment portfolio.

How to purchase USDC in the United States

Acquiring USDC within the U.S. is a straightforward endeavor. It commences with selecting a reputable cryptocurrency exchange, followed by the establishment of an account. Subsequently, users deposit the necessary funds to facilitate the acquisition of USDC.

In addition to being available on various exchanges, USD Coin (USDC) is a prominent stablecoin that investors can access through major cryptocurrency platforms. This guide aims to illuminate the process of purchasing USDC on a cryptocurrency exchange, empowering investors with the knowledge to navigate their investment decisions effectively.

- Selecting a Cryptocurrency Exchange

Prioritizing security is paramount when choosing a cryptocurrency exchange. Before initiating a USDC purchase, investors should acquaint themselves with the fees, regulations, and reputation of different exchanges, while also consulting online reviews.

In the United States, a multitude of exchanges operate, offering investors a diverse array of options. Among the prominent exchanges facilitating USDC conversions, investors can opt for platforms renowned for their accessibility, reputation, or robust security measures. Some notable exchanges and USDC trading platforms in the U.S. include Crypto.com, Gemini, Bybit, and eToro.

- Account Creation on a Cryptocurrency Exchange

Registration on an exchange typically commences with providing an email address. New users are often required to undergo Know Your Customer (KYC) verification, which entails submitting a photo of an ID or another legally recognized document. It’s imperative for customers to utilize all available security features provided by the exchange to safeguard their investment endeavors.

- Deposit and Purchase USDC

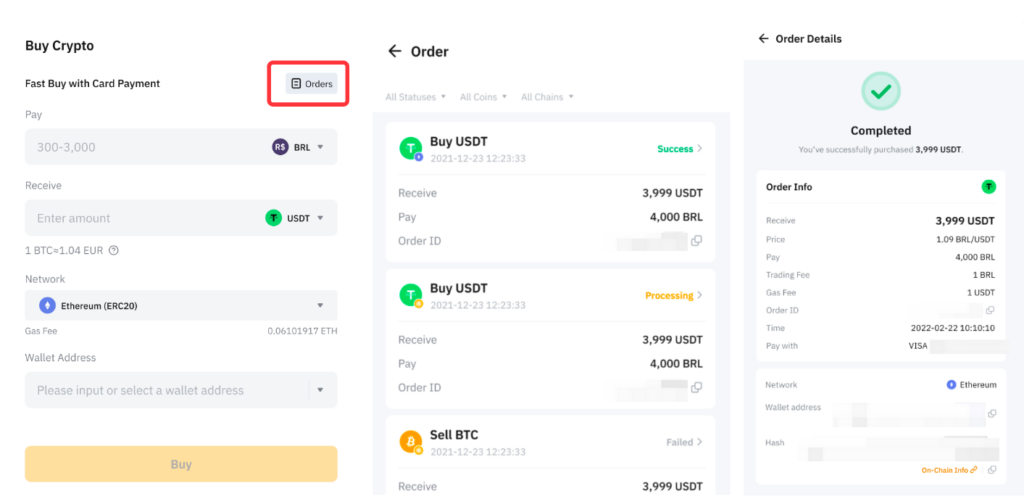

Once the account setup is complete, users can proceed to deposit funds from their fiat accounts into the chosen cryptocurrency exchange to initiate the purchase of USDC. This can typically be achieved by selecting a fiat-to-USDC conversion option or opting for an alternative trading pair. Many exchanges streamline the purchasing process, offering a simple one-step buy procedure that facilitates the acquisition of USDC through fiat transfers or bank cards.

On most platforms, acquiring USDC is as easy as clicking the “Buy” button, where users can specify the desired quantity of coins they wish to purchase. Major exchanges may offer various order types for buying USDC, providing users with flexibility in their trading strategies.

How to Acquire USDC on a Peer-to-Peer (P2P) Platform

Peer-to-peer (P2P) cryptocurrency exchanges offer an alternative avenue for users to trade USDC directly with one another. Users can peruse the asset listings of sellers on P2P exchanges, negotiate pricing, and finalize terms before executing any transactions.

To purchase USDC on a P2P platform, users should identify a reputable seller, verify their reputation and transaction history, and agree upon a suitable payment method with an equitable exchange rate. Upon confirmation of payment, USDC held in escrow is released to the designated wallet, completing the transaction.

In addition to traditional trading options, major exchanges in the United States often offer peer-to-peer (P2P) functionalities as part of their services. Among the exchanges facilitating P2P trading in the United States are Binance.US, Paxful, OKX, and KuCoin.

However, it’s crucial to exercise vigilance, as P2P transactions come with inherent risks such as potential fraud and scams. When choosing a P2P platform, it’s advisable to consider factors like user feedback, platform reputation, and available safety features.

Purchasing USD Coin via Telegram

Telegram has emerged as an alternative platform for acquiring USD Coin, providing a convenient avenue for conducting transactions. To buy USDC, buyers and sellers engage directly through Telegram channels and bots. Users can join these channels or utilize Telegram bots to negotiate terms and facilitate USD Coin transactions.

While this method may seem straightforward, it’s important to proceed with caution. Before initiating a USDC purchase, it’s essential to verify the seller’s reputation and confirm the legitimacy of the Telegram channel to ensure secure transactions.

Purchasing USDC through Fintech Apps

Numerous fintech applications, including Revolut, Skrill, and MoonPay, offer features for individuals seeking to acquire USDC directly within their platforms.

To buy USD Coin, individuals need to register an account with their preferred fintech app. Once the account is set up, users can effortlessly purchase and trade USDC using fiat currencies and other cryptocurrencies directly through the platform.

Using USDC for Online Transactions

USDC holders have various options for utilizing their tokens for online transactions. Firstly, USDC can be used to purchase other cryptocurrencies of choice. Users simply need to access a cryptocurrency exchange and select their preferred coin for conversion from USDC.

Additionally, with USDC, individuals can purchase gift cards from numerous popular retailers such as Amazon, Spotify, Ikea, and Nike. Furthermore, USDC can be used to register domain names for websites, providing flexibility and utility beyond the realm of traditional financial transactions.

Is Purchasing USDC Safe?

Investing in USD Coin is generally considered a secure option due to its stable value, as it is pegged to the U.S. dollar. This stability minimizes volatility, although occasional instances of depegging may occur.

Furthermore, USDC operates on a blockchain network with robust security protocols, reducing the risk of hacking or fraudulent activities. Despite these safety measures, it’s important to note that like many other cryptocurrencies, the value of USDC can be unpredictable and subject to significant fluctuations in the market.

To ensure the safe storage of USDC, investors have various options for cryptocurrency wallets. For enhanced security, transferring USDC to a hardware wallet, also known as a “cold wallet,” is advisable. Hardware wallets like Ledger, Arculus, and Trezor are physical devices specifically designed to store cryptocurrencies like USDC, offering increased protection against cyber threats.

Ensuring Secure Storage for USDC

For those seeking secure storage solutions for USDC, paper wallets present an offline storage method that effectively safeguards data against cyber threats. Alternatively, individuals may choose to utilize downloadable cryptocurrency software wallet applications such as Exodus, Trust Wallet, or Vibes, enabling convenient storage of USDC on personal devices.

Additionally, various exchanges like Kraken, Coinbase, and OKX provide integrated cryptocurrency wallets, allowing users to manage their holdings directly on the platform. However, it’s important to note that while convenient, users should exercise caution when using exchange-provided wallets, as they may have limited control over private keys, raising concerns regarding ownership and security.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.