Bitcoin is down about 19% in the month of December, dashing hopes of several analysts who were anticipating a blow-off top to end the year. The US Fed’s announcement that it will shrink its bond-buying program and could increase interest rates three times in 2022, and the uncertainty created due to the omicron variant may have led to a risk-off environment.

However, veteran trader Peter Brandt said in a recent Tweet that Bitcoin’s “key bottoms have occurred with high volume panic capitulation” which has not yet occurred.

Bitcoin has been finding support at the 200-day simple moving average (SMA) for the past few days but is struggling to sustain the rebound. This suggests a lack of demand at higher levels. The 50-day SMA has turned down and the relative strength index (RSI) has been trading in the negative territory, indicating that bears are in control.

A break and close below the 200-day SMA will be a huge negative as that will dent sentiment further and drive away the bulls. The BTC/GBP pair could then drop to £29,000 and later to £26,845.

The longer the price sustains below the 200-day SMA, the greater the possibility of an extended downtrend. Contrary to this assumption, if the price rebounds off the current level and rises above the downtrend line, it will suggest that the selling momentum has weakened. The pair could then rise to the 50-day SMA.

A break and close above this level could open the doors for a possible rally to £45,306.70 and then to the all-time high at £51,000. We will wait for the price to bounce and sustain above the downtrend line before recommending any long trades.

Lastly please check out the advancement’s happening in the cryptocurrency world.

Enjoy the issue!

FEATURING IN THIS WEEKS EDITION

– World Mobile Token

– Artex

– DeepSquare

– Quizarena

– Fren

– Funganomics

– Candao

– Euler

– Solidus

– Giving To Services

CRYPTO TRADE OPPORTUNITIES

BITCOIN – BTC/GBP

Bitcoin has been finding support at the 200-day simple moving average (SMA) for the past few days but is struggling to sustain the rebound. This suggests a lack of demand at higher levels.

The 50-day SMA has turned down and the relative strength index (RSI) has been trading in the negative territory, indicating that bears are in control Read more

ETHEREUM – ETH/GBP

The bears have repeatedly pulled Ether below the 100-day SMA in the past few days but the long tail on the candlesticks suggests strong buying at lower levels.

However, a minor negative is that the bulls have not been able to build upon the bounce off the 100-day SMA. This suggests a lack of demand at higher levels. Read more

RIPPLE – XRP/GBP

XRP plummeted below the strong support at £0.63 on December 4 but the bears could not capitalise on this weakness. This suggests that selling dried up at lower levels.

The XRP/GBP pair has been trading between £0.56 and £0.69 for the past few days. The RSI has risen close to the midpoint, indicating that the bearish momentum has weakened. Read more

CARDANO – ADA/GBP

Cardano broke below the support line of the descending channel on December 9, indicating that the selling pressure was increasing. The bulls attempted to push the price back into the channel but failed.

This suggests that the bears have flipped the support line of the channel into resistance. The bearish crossover suggests that sellers are firmly in the driver’s seat. Read more

BINANCE – BNB/GBP

Binance Coin has been bouncing off the support of the large range between £377 and £493.20 but a minor negative is that bulls have not been able to push the price above £411.50.

This tight-range trading is unlikely to continue for long. If bears sink and sustain the price below £377, the BNB/GBP pair could start a decline to £320 and later to £286.80 Read more

Subscribe to the latest crypto news digital magazine for the latest updates about profit and loss in cryptocurrency.

Euler: A non-custodial protocol for lending and borrowing crypto assets!

One of the leading industries that have been affected by blockchain technology is the finance industry. This led to many decentralised finance platforms mushrooming as the demand for lending and borrowing assets grew by the day. Unlike the traditional finance systems, decentralized finance systems are based on the blockchain, and hence, they don’t need any third parties or intermediaries to do transactions. Read more

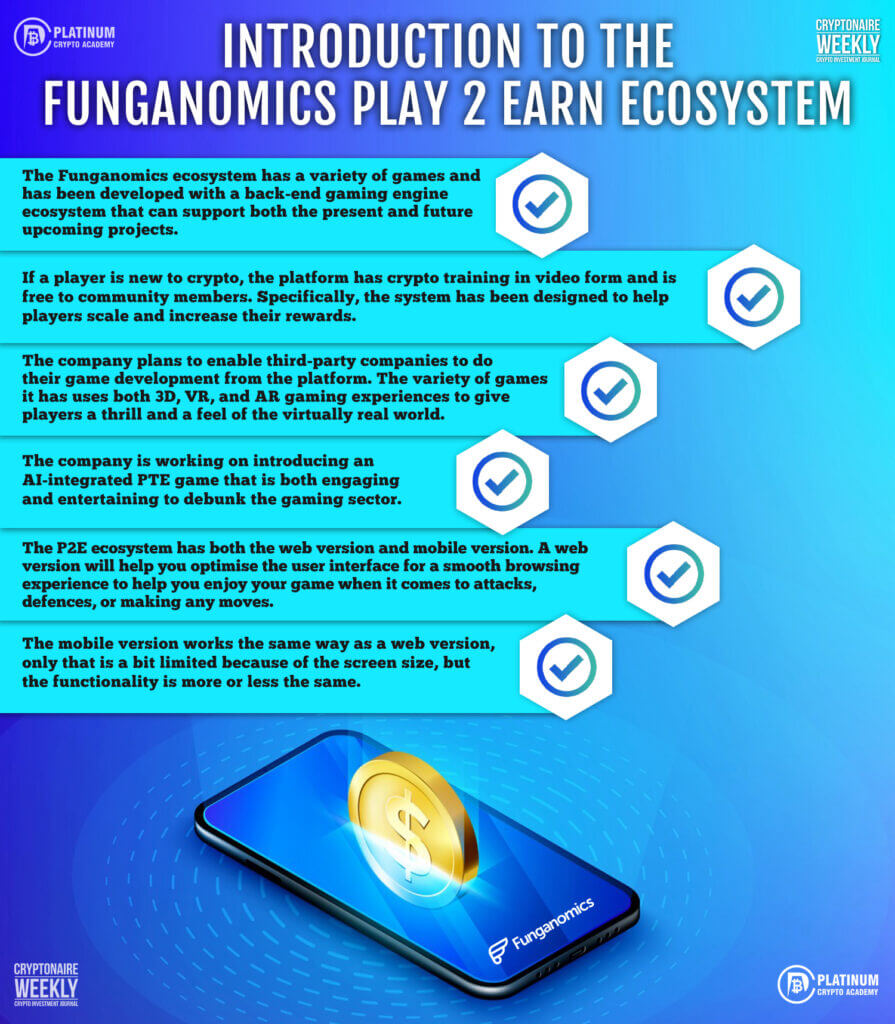

Funganomics: Play 2 Earn Gaming Ecosystem Powered By Blockchain

The gaming ecosystem has evolved with time. Since the pandemic, gaming has grown on a big scale, and gaming platforms are doing innovations every day to make it more enticing for the players.

Blockchain, in particular, has been a main game-changer in the gaming industry. Blockchain has been embraced to increase transparency since it is an open ledger to reduce intermediaries so that prices are fair. Since the evolution of blockchain, gaming has been honest, transparent, and has led to the industry’s growth. Read more

Fren: Watch out for the next big crypto trend!

Intro Fren

Fren is a platform that seeks to enable members of its community to learn together, play together and invest together. This concept is what inspired the name of this platform which is a short form of Friends. The Fren platform is built on the foundation of anonymity and decentralisation. There are a total of 1 trillion tokens that have been supplied. Out of all this, 16 billion have been locked through a time lock smart contract while the rest are in circulation. The current market cap of this platform is about $ 3 million, with a daily trading volume upwards of $ 500k.This shows that there is liquidity on this platform, and in the event that crypto investors may want to purchase or cash out, then they can easily do that. Read more

Dubai World Trade Centre To Become A Crypto Hub For Regulation

The Dubai World Trade Centre (DWTC) will become a crypto zone and regulator for virtual assets and crypto, comprising digital assets, goods, operators, and exchanges, as part of the Dubai government’s efforts to build new economic sectors. Dubai Likes Crypto The United Arab Emirates (UAE) is becoming one of the world’s most cryptocurrencyfriendly jurisdiction, with the Dubai government announcing a new program to assist local cryptocurrency development and regulation.

Artex: Invest in art using blockchain technology!

There is no doubt that the crypto fine arts industry is growing rapidly. With the rapid pace of technological development, the art market and its community are experiencing rapid change. Since the adoption of blockchain in the art market, artists, collectors, and galleries have been experiencing new opportunities. Investing in Fine Art through Artex brings the best benefits for both collectors and artists Read more

Digital Asset Funds Hit by Record $142M of Outflows

Investors pulled money out of funds focused on bitcoin and the currencies of Ethereum, Solana and Polkadot, as crypto markets retreated. With cryptocurrency markets drifting downward, digital-asset investment products have suffered their largest weekly redemptions on record.

Ethereum co-founder makes surprise visit to Argentina, what is Buterin planning?

Vitalik Buterin meets the former head of state who mentions “blockchain opportunities” in a tweet about the meeting. Ethereum co-founder Vitalik Buterin made an unannounced visit to Argentina last Friday. The eccentric programmer was first spotted in the

Google Trends 2021 Edition: NFTs Look to Break the ATH Record

Google trends data has confirmed the massive demand growth for NFTs as the number of worldwide searches is about to set a new ATH. From being dismissed as a passing fad to slowly disrupting the art and music industry, if anything history has taught us – is that the significance of any invention or innovation becomes clear when the hype fades. The NFT phenomenon, on the other hand, seems quite different. The latest Google keyword search data demonstrated that interest in this space has surged to record levels.

Indian parliament’s agenda for winter session no longer includes crypto bill

The Cryptocurrency and Regulation of Official Digital Currency Bill doesn’t appear among the bills that India’s lower house will consider as it concludes the winter session. The Indian government may still be considering a bill that could ban certain cryptocurrencies in the country, but lawmakers are unlikely to vote on any legislation in the current parliamentary session.

FTX US Partners With Monumental Sports Entertainment, Gets Exposure to 4 New Sports Teams

FTX continues its path toward the sports world as it signed a partnership with Monumental Sports Entertainment (MSE) on Monday. The deal makes it so FTX US will be MSE’s exclusive crypto exchange and nonfungible token partner. FTX and Monumental Sports Entertainment to Collaborate Monumental Sports Entertainment (MSE)