Bitcoin broke above the 200-day simple moving average (SMA) on August 9, signalling that the downtrend is over. Fundstrat’s Tom Lee told CNBC on August 9 that buying Bitcoin “when it breaks above its 200-day moving average” has rewarded investors with a six-month return of almost 180%. Lee expects Bitcoin to rally to about $100,000 by the end of the year.

Financial news outlet The Street reported on July 30 that asset management firm GoldenTree, which has about $45 billion in assets under management, has bought an undisclosed amount of Bitcoin.

OUR BLOG ARTICLES FOR THIS SPECIAL ISSUE ARE

SUBME – AN INVESTMENT TOOL THAT DISRUPTS THE SUBSCRIPTION

MARKET!

&

WORLD MOBILE TOKEN: REBOOTING TELECOMS THROUGH

BLOCKCHAIN AND THE SHARING ECONOMY

We had said in our previous analysis that a short-term trading opportunity may open up if Bitcoin rebounds off the 20-day exponential moving average (EMA) and that is what happened. Traders who bought on our recommendation may book partial profits and trail the stops higher on the rest of the position.

The BTC/GBP pair turned down from £30,310.12 on August 1 but the bulls aggressively defended the 20-day EMA. This suggests that the sentiment has turned positive and traders are viewing dips as a buying opportunity. The pair bounced off the 20-day EMA on August 4 and the bulls pushed the price above the overhead resistance of £31,005 on August 7. The bears tried to trap the bulls by pulling the price back below the breakout level of £31,005 on August 8 but the long tail on the day’s candlestick shows strong buying at lower levels.

If buyers sustain the price above £31,005, the pair could start its journey to £36,000 and then to £38,000. The rising moving averages and the relative strength index (RSI) in the overbought zone suggest that bulls are in control.

This positive view will invalidate if the bears pull the price back below the 20-day EMA. Such a move could open the doors for a decline to £26,926.16.

Lastly please check out the advancements happening in the cryptocurrency world.

Enjoy the issue!

FEATURING IN THIS WEEKS EDITION

Dirty Finance

– Hypersign

– GSX

– Gain Protocol

– Kaiken

– Neftipedia

– The Coop Network

– BeatBind

– Ferrum Network

– World Mobile Token

– ClearMoon

– Subme.Cash

– Wasder

CRYPTO TRADE OPPORTUNITIES

BITCOIN – BTC/GBP

We had said in our previous analysis that a short-term trading opportunity may open up if Bitcoin rebounds off the 20-day exponential moving average (EMA) and that is what happened. Traders who bought on our recommendation may book partial profits and trail the stops higher on the rest of the position. Read more

ETHEREUM – ETH/GBP

In our previous analysis, we had recommended traders buy on a strong rebound off the 20-day EMA. The price did not drop to the 20-day EMA but came close to it on August 4. Traders who bought this bounce would have made quick gains. Read more

RIPPLE – XRP/GBP

The tight range consolidation between the 20-day EMA and the overhead resistance at £0.53566 resolved to the upside on August 7. This triggered the buy recommendation given in the previous analysis. The bulls are struggling to sustain the upward momentum as bears are attempting to pull the price back below the breakout level. Read more

CARDANO – ADA/GBP

Cardano broke above the 50-day SMA on August 3 and has continued its move higher. The rising 20-day EMA and the RSI in the positive zone suggest that bulls have the upper hand. Read more

BINANCE – BNB/GBP

Binance Coin broke and closed above the overhead resistance of £236 on August 6 which triggered the buy recommendation given in the previous analysis. However, the bulls are struggling to build on the breakout as bears are trying to pull the price back below £236. Read more

Subscribe to the latest crypto news digital magazine for the latest updates about profit and loss in cryptocurrency.

DIRTY FINANCE HITS Q3 ALL TIME HIGH ON CONTEST LAUNCH, STAKING ANNOUNCEMENT

According to Google Search Trends, Bitcoin and Ethereum lead the pack of cryptocurrencies that people search for on Google, but many cryptocurrencies are experiencing a resurgence, and investors hope the possible revived market might signal sustained growth. For example, Dirty Finance ($Dirty:P2PBNB), a small cap ERC-20 token available on P2PB2B.io, Tokpie and Uniswap, recently hit a 43-day all time high after a successful “Who Wants To Be A Dirty Finance Billionaire” contest launch picked up by the global PRNewswire. Read more

BEARS LICK THEIR PAWS WHILE BITCOIN PRICE BLASTS THROUGH $46,000

Derivatives data show the market is dominated by longs and that top traders added leverage as BTC price rallied to $46,300. Bitcoin (BTC) hiked 20% in seven days in an unexpected move that brought the price to its highest level since May 18. The price appreciation happened despite U.S. Treasury Secretary Janet Yellen reportedly supporting a broader definition Read more

SUBME – AN INVESTMENT TOOL THAT DISRUPTS THE SUBSCRIPTION MARKET!

The subscription business has increased dramatically in recent years, with some regions reporting a nearly 100 per cent increase. Consumers today want personalised, frictionless, and flexible products and services. Observing the current subscription sector, one can conclude that it is no longer restricted to magazines and newspapers but has expanded its network to include media, entertainment, consumer goods, and businesses. Read more

COINBASE ADDS OPTION TO BUY CRYPTO WITH APPLE PAY, GOOGLE PAY TO FOLLOW

Crypto continues to see tremendous growth these past weeks. Prices of coins have soared across the board as sentiments continue to skew in the positive. Investors seem to be pouring back into the market, with the market showing patterns that indicate current buy pressure trends are higher than sell pressures. Accumulation patterns continue to show that investors are hoarding their coins instead of selling, as exchange reserves continue to plummet across the board. Read more

AUDI TO DEBUT ITS LIMITED-EDITION NFTS ON XNFT PROTOCOL

The German automaker will release the NFTs on 10 August in a joint venture with FAW-Volkswagen Audi is set to unveil limited-edition non-fungible tokens (NFTs), the German automobile maker has revealed. The company will collaborate with xNFT Protocol, a decentralised network platform that allows for the creation and exchange of NFTs, Audi said via a post on its Weibo account. xNFT also confirmed the move via Twitter. In its announcement, Audi released a 15-second video that highlighted the limited-edition NFTs on offer. The manufacturer also revealed that the collectibles will be a joint venture with FAWVolkswagen, a group that manufactures the Audi and Volkswagen passenger vehicles targeted at the Chinese market. Read more

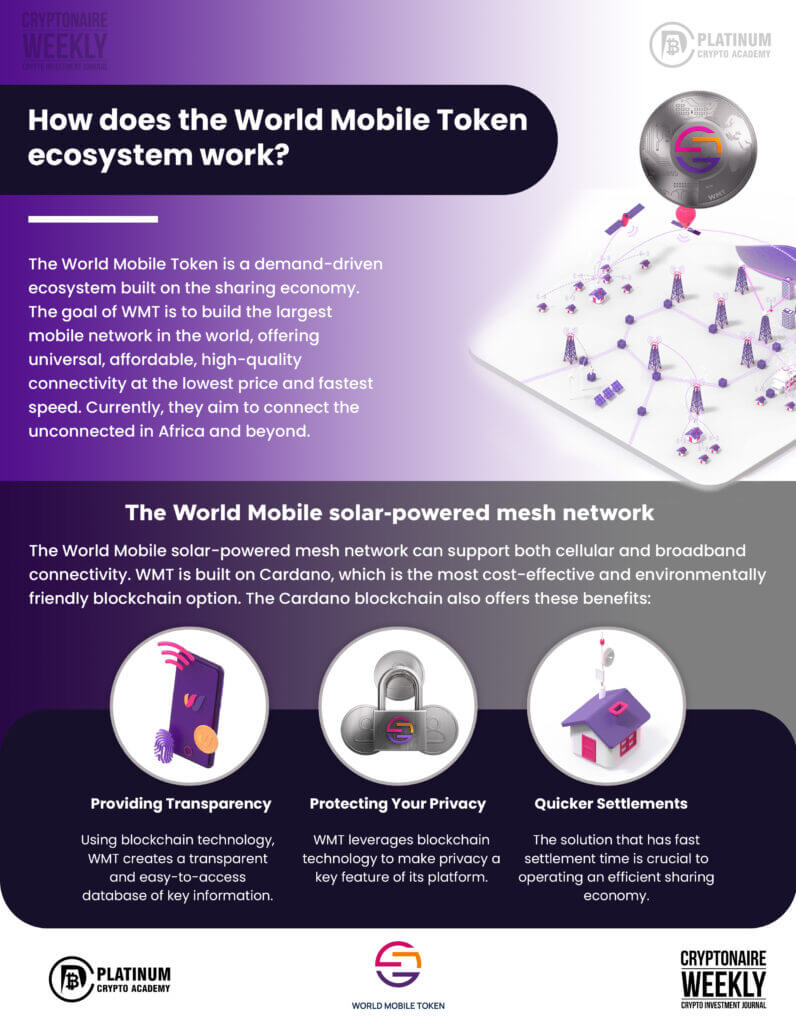

WORLD MOBILE TOKEN: REBOOTING TELECOMS THROUGH BLOCKCHAIN AND THE SHARING ECONOMY

In this world of modern connectivity, World Mobile Token is going further than ever before. WMT is developing a technology mesh network using a hybrid spectrum, renewable energy, and blockchain. All transactions on the blockchain occur on the Earth Nodes, which are the heart of Word Mobile Network. Furthermore, the network is secure and sustainable for the next generation as well. Read more

DOGECOIN, SHIBA INU POST BIG WEEKLY GAINS IN MEME COIN RESURGENCE

Is meme momentum back in full swing? DOGE’s uptick is ahead of the market, while a token burn seemingly gives SHIB a bump. Dogecoin has seen a 27% price bump over the last week, greater than Bitcoin or Ethereum in the same span. Read more

ETHEREUM NETWORK BURNS $395K ETH PER HOUR AFTER LONDON UPGRADE

At current burn rates, 2.3 ETH per minute, or $6,600, is going up in smoke. Approximately 2.3 Ether (ETH) is being burnt every minute through the new transaction fee mechanism introduced in Ethereum’s London upgrade on Thursday. The highly anticipated London hard fork went live on Thursday this week, ushering in the Ethereum Improvement Proposal (EIP) 1559 upgrade that adjusted gas fees. Part of that adjustment introduced a mechanism that burns some of the base fees collected. Read more

POLONIEX SETTLES FOR $10 MILLION WITH SEC FOR ‘AGGRESSIVE’ LISTING POLICY

Crypto exchange Pononiex has settled for $10 million with the U.S. Securities and Exchange Commission for selling digital securities. From July 2017 through November 2019, the SEC alleged that the Seychelles-based crypto exchange facilitated the buying and selling of “digital assets that were investment contracts and therefore securities.” Poloniex didn’t admit or deny the SEC’s findings. Read more

SEVERAL CRYPTO MINING STOCKS UP SHARPLY AS BITCOIN RISES ABOVE $46K

The increase also came at a time when bipartisan support emerged for excluding miners from being considered “brokers” in the U.S. infrastructure bill. Crypto mining stocks rallied on Monday on the recent rise in bitcoin’s price, as well as on support for an amendment to the U.S. infrastructure bill that would specifically exclude miners from additional tax reporting requirements. Read more

WASDER ECOSYSTEM – AN ECOSYSTEM DESIGNED FOR GAMERS!

There are around 2.7 billion gamers on the planet. However, it is still unclear if the gaming industry has its own social media platform based on cryptocurrency. So, how many feeds would you have to go through to find the information you need? Wasder ecosystem aims to target this area by offering a gamified, token based ecosystem. It is a platform where you can play individually or as a group and have a chatroom where you can make friends. If this makes you curious enough to want to know more about Wasder, you’re in for a treat. Read more

SINGAPORE TO LICENSE DIGITAL PAYMENT PROVIDERS, APPROVES CRYPTO EXCHANGE

The Monetary Authority of Singapore (MAS) has notified several providers of digital payment services that they will be licensed to operate in the city-state. The move, which comes after the approval of a crypto exchange for a license, secures Singapore’s status as Asia’s crypto hub, industry observers say. Read more

UKRAINE COULD LEGALIZE BITCOIN PAYMENTS AFTER PROPOSED CRYPTO BILL

Ukrainian government drafted a roadmap for the integration of crypto into the country’s economy. After the crypto draft bill is adopted, Ukrainians will be able to legally hold, exchange, and spend cryptocurrencies like Bitcoin (BTC), a government official revealed. Besides allowing payments in cryptocurrencies, the Ukrainian Digital Transformation Ministry proposes lower crypto taxes as the new legislation seeks to pave the way for the industry to enter the country. Read more