Despite the slight downturn, the institutional adoption of Bitcoin continues to increase. Filings with the United States Securities and Exchange Commission show that four wealth management firms have bought shares in Grayscale’s Bitcoin Investment Trust.

A survey of about 42,000 people in 27 countries by product comparison website Finder showed a high adoption rate in Asia. Among the countries polled, Vietnam had the highest adoption rate at 41%, while India and Indonesia had a 30% adoption rate.

OUR BLOG ARTICLES FOR THIS SPECIAL ISSUE ARE BEATBIND: IRONING OUT MUSIC INDUSTRY’S BIGGEST BLOCKERS WITH BLOCKCHAIN,

MINING WATCHDOG: PEER-TO-PEER CRYPTO INVESTING PLATFORM,

MAXIMISE THE RETURN ON YOUR CRYPTO INVESTMENTS WITH GSX TOKENS FROM SECURITY OF GOLD,

FERRUM NETWORK’S ADOPTION OF BLOCKCHAIN & CROSS-CHAIN TOKEN BRIDGE & KAIKEN INU: A FEATURE-PACKED DEFLATIONARY TOKEN WITH REAL USE CASE

Bitcoin will take a big leap on Tuesday as it becomes legal tender in El Salvador. With this step, Salvadorans will be able to use Bitcoin for buying goods and services and also pay for taxes. Ahead of its Tuesday deadline, President Nayib Bukele tweeted that El Salvador had purchased 400 Bitcoin.

Bitcoin bounced off the 20-day exponential moving average (EMA) on September 1, indicating strong buying by the bulls on dips. The buyers continued their momentum and pushed the price above the 61.8% Fibonacci retracement level at £36,834.35 on September 5. If bulls sustain the price above this level, the BTC/GBP pair could continue its journey toward £42,650. Although the upsloping moving averages favor the bulls, the negative divergence on the relative strength index (RSI) indicates that the bullish momentum may be slowing down.

Lastly please check out the advancement’s happening in the cryptocurrency world.

Enjoy the issue!

FEATURING IN THIS WEEKS EDITION

– BeatBind

– Insurace

– Mining

– DeGeThal

– GSX

– MELD

– Ferrum Network

– Radiologex

– Kaiken

CRYPTO TRADE OPPORTUNITIES

BITCOIN – BTC/GBP

Bitcoin price GBP bounced off the 20-day exponential moving average (EMA) on September 1, indicating strong buying by the bulls on dips. The buyers continued their momentum and pushed the price above the 61.8% Fibonacci retracement level at £36,834.35 on September 5. If bulls sustain the price above this level, the bitcoin to GBP pair could continue its journey toward £42,650. Read more

ETHEREUM – ETH/GBP

Ether rebounded off the 20-day EMA on August 31 and soared above the overhead resistance zone at £2,400 to £2,466. This signalled the resumption of the uptrend. The upsloping moving averages indicate advantage to the bears but the negative divergence on the RSI warns of a possible correction or consolidation. The ETH/GBP pair is facing resistance in the £2,900 to £3,098.17 overhead zone. Read more

RIPPLE – XRP/GBP

The bulls successfully defended the 20-day EMA on August 30, which may have attracted buying on August 31. After hesitating near £0.938 for a few days, the buyers finally scaled this resistance on September 6. If bulls sustain a price above £0.938, the XRP/GBP pair could rally to the overhead zone of £1.20 to £1.4319. Read more

CARDANO – ADA/GBP

The bulls pushed Cardano above £2.16173 on September 2 and 3 but could not sustain the higher levels. This suggests that bears are defending the overhead resistance aggressively. The bears will now try to pull the price down to the 20-day EMA. This is an important support to watch out for. Read more

BINANCE – BNB/GBP

Binance Coin bounced off the 20-day EMA on August 31 but the bulls have not been able to drive the price above the overhead resistance at £377. This suggests that buying dries up at higher levels. The BNB/GBP pair could now drop to the 20-day EMA. A break below this support could pull the price down to the breakout level of £305.40. If this support holds, the pair could consolidate between £305.40 and £377 for a few days. Read more

Subscribe to the latest crypto news digital magazine for the latest updates about profit and loss in cryptocurrency.

INSURACE.IO – THE FIRST MULTI-CHAIN INSURANCE PROTOCOL TO LAUNCH ETHEREUM, BINANCE SMART CHAIN, AND POLYGON.

Decentralized Finance (DeFi) aims to offer financial services by leveraging decentralized technologies, mainly public blockchain networks, openly and transparently with universal accessibility. It has been at the forefront since 2019 and exploded in 2020. With the advent of DeFi, cyber security issues pose a significant threat to DeFi ecosystem. The more demand for DeFi Insurance has led to the development of insurance protocols in the market.

BEATBIND: IRONING OUT MUSIC INDUSTRY’S BIGGEST BLOCKERS WITH BLOCKCHAIN

Crypto for the music industry is an upcoming concept, and one that is being widely appreciated by those searching for innovative crypto projects. This is where new crypto tokens such as Beatbind come into the picture. Beatbind is essentially an ERC20 utility token that caters to the musical events industry. The platform offers a truly worldwide, trustless and affordable method of payment in the form of the BBND or Beatbind tokens. Read more

SOLANA HITS ALL-TIME HIGH AS COIN RISES 14% IN 24H

Some people are starting to call this season “Solana Summer.” Solana (SOL) has hit yet another all-time high. The price of the cryptocurrency is now $157. The 24-hour increase of 14.71% makes the coin the seventh-largest cryptocurrency with a market cap of $45.8 billion. Read more

MAXIMISE THE RETURN ON YOUR CRYPTO INVESTMENTS WITH GSX TOKENS FROM SECURITY OF GOLD

Gold Secured Currency is the world’s first growth token and the first token with an increasing asset value. GSX offers its owners the benefits of a minimum asset value, similar to that of stable cryptocurrency, and the ability to grow in value. GSX blends the advantages of the best stable coins and cryptocurrencies into a single trust-secured coin that offers the best of both worlds. Read more

94% FINANCIAL INDUSTRY PIONEERS SAY DIGITAL ASSETS WILL REPLACE FIAT IN 5-10 YEARS: DELOITTE REPORT

Participation in the age of digital assets is not an option—it is inevitable,” says the report, as digital assets have a fundamental impact on deposits and with organizations’ current business models at stake. An impressive 97% of the financial services industry (FSI) Pioneers and more than threequarters of all respondents see blockchain and digital assets as a way to gain competitive advantage reports Deloitte 2021 Global Blockchain Survey Read more

MINING WATCHDOG: PEER-TO-PEER CRYPTO INVESTING PLATFORM

Since cryptocurrency platforms keep popping up each passing day, all that’s left is for miners to stay updated with the upcoming one. That information is essential because it makes it easy to make the right decision when choosing one. First, some platforms are a scam, and that’s something every investor will have to avoid, like a plague, to avoid incurring losses. Read more

TWITTER TO ALLOW USERS RECEIVE BITCOIN AND ETHEREUM VIA ITS TIP JAR FEATURE

S oon Twitter may allow its subscribers to include Ethereum and Bitcoin cryptos in their portfolios for receiving crypto tips. Alessandro Paluzzi, in a tweet, backed the claim confirming that Twitter is working hard to achieve this aim. It will enable users to add the two crypto addresses to their profile to get tips through Tip Jar Feature. Alessandro, the app developer, added. Related Reading | Singapore Central Bank Selects 15 Firms For Retailing CBDC Read more

INDIA HAS NEW PLAN TO REGULATE CRYPTOCURRENCIES

India is reportedly working on a new way to regulate cryptocurrencies. “The government is planning to define cryptocurrencies in the new draft bill that also proposes to compartmentalise virtual currencies on the basis of their use cases,” according to a report. How India Will Regulate Cryptocurrencies India is reportedly planning to regulate cryptocurrencies as commodities based on use cases.

LINK PRICE LOCKS IN 36% GAINS FOLLOWING ETHEREUM LAYER 2’S CHAINLINK INTEGRATION

surged in the wake of a marketwide bullish boom, wherein Bitcoin and its top rivaling altcoins jumped in tandem. Chainlink emerged as one of the best cryptocurrency performers on Sept. 6 as the price of its LINK token jumped 8.25% Read more

FTX LAUNCHES CROSS-CHAIN NFT MARKETPLACE FOR BOTH US AND GLOBAL USERS

Cryptocurrency exchange FTX now allows anyone to make their own non-fungible tokens (NFT). On Monday, the CEO Sam Bankman-Fried took to Twitter to share that the DIY NFT listing is available on both FTX for global users and FTX.US for its American users. Just two weeks back, in an interview with CNBC, Bankman-Fried had noted about the NFT craze, saying, “It’s almost going mainstream faster than the mainstream understands what it is they’re adopting, which is a weird phenomenon. Read more

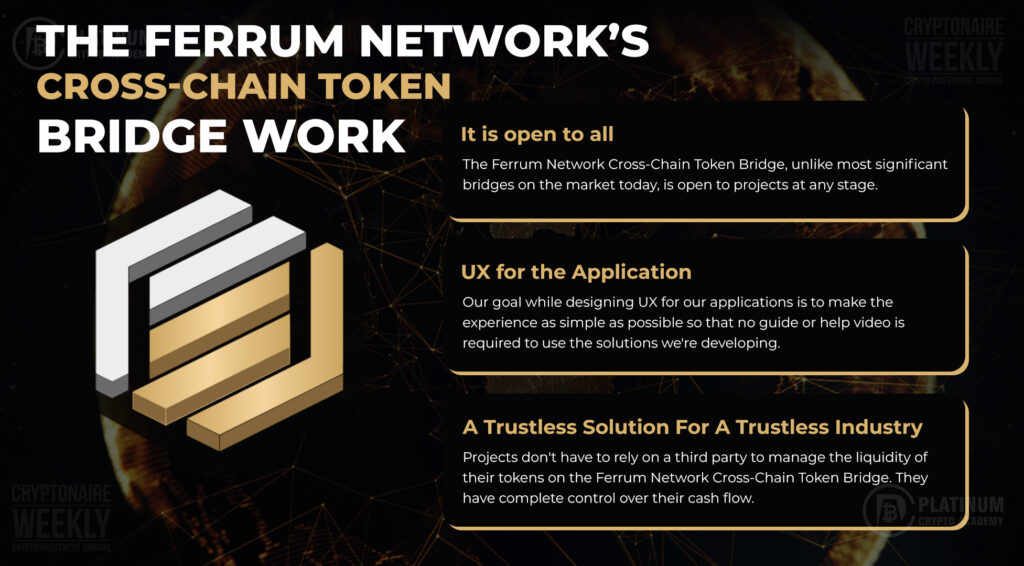

FERRUM NETWORK’S ADOPTION OF BLOCKCHAIN & CROSS-CHAIN TOKEN BRIDGE

Cryptocurrencies have grown into a trillion-dollar business, causing a wave of financial disruption around the world. Cryptocurrencies have a long history of innovation that dates back to the 1980s when cryptography developments were made. Since then, a succession of events has impacted the crypto world, the most notable of which is the first cryptocurrency, Bitcoin. Despite its meteoric rise over the past 12 years, financial services for Bitcoin have been reluctant to emerge, owing to its fundamental lack of stability and adoption. Read more

KAIKEN INU: A FEATURE-PACKED DEFLATIONARY TOKEN WITH REAL USE CASE

Over the past 18 months, DeFi protocols have taken the crypto markets by storm. There has been an unprecedented rise in the total value locked (TVL) of DeFi tokens. Now, as many institutional investors are jumping the DeFi bandwagon as retail and private investors, the data released by the top cryptocurrency exchanges reveal that more and more conventional investment giants are now betting big on decentralised finance. Read more

CRYPTO.COM NAMES FORMER VISA COUNTRY MANAGER TO HEAD SOUTH KOREA OPERATIONS

Crypto.com appointed Patrick Yoon, former country manager at Visa Korea and Mongolia, as its general manager for South Korea. Yoon’s experience in the country will help the crypto exchange reach “new heights,” CEO Kris Marszalek said in a statement. During his three-year stint at Visa, Yoon worked with regulatory bodies and financial institutions. Prior to his time at Visa, Yoon worked at Standard Chartered Bank in South Korea, Singapore, Taiwan and the U.K. The Crypto.com app offers trading, lending, and payment services. The firm also offers a Visa card to users who stake its token, CRO, for more than 180 days, according to its website.Read more