Despite the slight downturn, the institutional adoption of Bitcoin continues to increase. Filings with the United States Securities and Exchange Commission show that four wealth management firms have bought shares in Grayscale’s Bitcoin Investment Trust.

A survey of about 42,000 people in 27 countries by product comparison website Finder showed a high adoption rate in Asia. Among the countries polled, Vietnam had the highest adoption rate at 41%, while India and Indonesia had a 30% adoption rate.

Bitcoin and altcoins have made a strong recovery in the past week. The sentiment turned around after the U.S. Federal Reserve Chairman Jerome Powell, during a House Financial Services Committee meeting on September 30, made it clear that he does not intend to ban cryptocurrencies but said that stablecoins should be regulated. This energised the bulls who had been on the backfoot since China renewed its crackdown on crypto services on September 24.

Bitcoin bounced off the 100-day simple moving average (SMA) on September 29 and broke above the descending channel on October 1. This move suggests that the downtrend could be over. The 20-day exponential moving average (EMA) has turned up and the relative strength index (RSI) has jumped into the positive territory, indicating that bulls have the upper hand. The BTC/GBP pair could now rally to £38,257.06 where the bears are likely to mount a stiff resistance. If the bulls defend the 20-day EMA during the next dip, it will increase the possibility of a break above £38,257.06

If that happens, the pair may start its northward march to £42,653.53 and then retest the all-time high at £47,240.05. Alternatively, if the price turns down from the current level or the overhead resistance and breaks below the 20-day EMA, the pair could plummet to £31,011.

Lastly please check out the advancement’s happening in the cryptocurrency world.

Enjoy the issue!

OUR BLOG ARTICLES FOR THIS SPECIAL ISSUE INSURACE.IO: AN INNOVATIVE DEFI PROTOCOL TO SECURE YOUR CRYPTO INVESTMENTS

OMNIA DEFI: TOKENISATION OF REAL-WORLD ASSETS

BONDEX: A GROUNDBREAKING BLOCKCHAIN-BASED NETWORK THAT REDEFINES THE FUTURE OF WORK

MAKE YOUR CRYPTO INVESTMENT WITH THE BEST HYBRID INTELLIGENCE SYSTEM

THE WORLD FIRST ISPO ATTRACTS 1 BILLION USD WORTH OF ADA

Bitcoin and altcoins have made a strong recovery in the past week. The sentiment turned around after the U.S. Federal Reserve Chairman Jerome Powell, during a House Financial Services Committee meeting on September 30, made it clear that he does not intend to ban cryptocurrencies but said that stablecoins should be regulated. This energised the bulls who had been on the backfoot since China renewed its crackdown on crypto services on September 24.

Bitcoin bounced off the 100-day simple moving average (SMA) on September 29 and broke above the descending channel on October 1. This move suggests that the downtrend could be over. The 20-day exponential moving average (EMA) has turned up and the relative strength index (RSI) has jumped into the positive territory, indicating that bulls have the upper hand.

The BTC/GBP pair could now rally to £38,257.06 where the bears are likely to mount a stiff resistance. If the bulls defend the 20-day EMA during the next dip, it will increase the possibility of a break above £38,257.06 If that happens, the pair may start its northward march to £42,653.53 and then retest the all-time high at £47,240.05. Alternatively, if the price turns down from the current level or the overhead resistance and breaks below the 20-day EMA, the pair could plummet to £31,011.

Lastly please check out the advancement’s happening in the cryptocurrency world.

Enjoy the issue!

FEATURING IN THIS WEEKS EDITION

– Bondex

– Omnia

– MELD

– Mining

– Gain Protocol

– Aristo

– DeGeThal

CRYPTO TRADE OPPORTUNITIES

BITCOIN – BTC/GBP

Bitcoin has picked up momentum after breaking out of the descending channel. The rising 20-day exponential moving average (EMA) and the relative strength index (RSI) near the overbought zone indicate advantage to buyers.

The bears are currently attempting to stall the up-move at the overhead resistance at £42,653.53 but a positive sign is that bulls are not giving up much ground. This suggests that traders are not booking profits in a hurry and increases the possibility of a break above it Read more

ETHEREUM – ETH/GBP

Ether is facing stiff resistance near the overhead barrier at £2,700 but a minor positive is that bulls have not allowed the price to break and close below the 20-day EMA. This suggests that traders continue to buy on dips.

The gradually rising 20-day EMA and the RSI in the positive zone indicate a minor advantage to buyers. Read more

RIPPLE – XRP/GBP

XRP’s tight range trading between the 50-day SMA and the 20-day EMA resolved to the upside on October 9. However, the bulls could not build on this advantage as seen from the long wick on the October 10 candlestick.

The XRP/GBP pair formed a Doji candlestick pattern on October 11 and the bears are currently attempting to pull the price back below the 20-day EMA. Read more

CARDANO – ADA/GBP

Cardano broke and closed above the 20-day EMA on October 7 but the bulls could not clear the overhead hurdle at £1.75137. The failure to do so may have attracted profit-booking from short-term buyers and shorting by aggressive bears. Read more

BINANCE – BNB/GBP

The bulls could not sustain Binance Coin above the 50-day simple moving average (SMA), indicating a lack of demand at higher levels. This could have prompted short-term traders to book profits. The BNB/GBP pair broke and closed below the 20-day EMA on October 10. Read more

Subscribe to the latest crypto news digital magazine for the latest updates about profit and loss in cryptocurrency.

BITCCI: A BLOCKCHAIN SOLUTION FOR THE SEX INDUSTRY

The global sex market recorded over $200 billion at the end of the year 2020. The potential for the sex market is great because the internet significantly alters the perception of sex services ease and accessibility to the users. While comparing it historically i.e. 1980, the number of individuals who purchase sex services doubled globally. However, along with great potential, it also faces some of the major challenges for which bitcci creates unique solutions. This article will discuss the sex industry challenges and how bitcci is revolutionising the sex industry. Read more

EVERYTHING YOU NEED TO UNDERSTAND ABOUT THE DEGETHAL ECOSYSTEM

Decentralised Thaler, DeGeThal, is a platform tasked with creating a “one-stop” ecosystem for various use cases unexplored by traditional financial instruments. Read more

RMRK LAUNCHES MONTH-LONG $50000+ NFT HACKATHON

Zug, Sept 30th 2021 – RMRK Association – the steward and main developer of the world’s most advanced NFT protocol – announced a launch of the RMRK Hackathon on Devpost with a prize pool of $50’000 plus valuable NFTs.

The hackathon, in partnership with ecosystem heavy-hitters like PAKA, Phala, PoCoCo, D1, Signum, Illusionist Group, Subsquid, and AMPnet, is meant to expand the NFT ecosystem on Dotsama (Polkadot and Kusama) by building on top of and around the RMRK protocol and its tools and products. Read more

RIPPLE TEAMS WITH NELNET ON $44M SOLAR INVESTMENT

The joint investment will fund solar energy projects throughout the U.S. as crypto firms try to reduce the industry’s carbon footprint. Crypto-powered digital payment service Ripple has made a $44 million joint Environmental, Social, and Governance (ESG) investment with Nelnet (NYSE: NNI) Renewable Energy into one of Nelnet’s solar energy funds, the firms announced Monday.

DISRUPTING DEFI, INSURACE.IO PROVIDES BEST SECURITY FOR YOUR CRYPTO ASSETS

The insurance industry has been in existence since time memorial, but the concept of decentralised insurance is newer to investors. Decentralised insurance comes with benefits for investors range from efficiency, increase in trust, and inclusion of smart contracts. On the other hand, investors have a fear of cyber-attacks, loss of integrity of data, as well as high costs that tend to push away investors. Whereas these challenges are evident, platforms are coming up to counter these concerns so as to secure and protect crypto investments. InsurAce.io is curbing the mentioned challenges, thus disrupting decentralised finance. Read more

MONEYGRAM PARTNERS WITH RIPPLE COMPETITOR STELLAR, WILL SETTLE TRANSACTIONS WITH USDC STABLECOIN

MoneyGram International, Inc., one of the largest money transfer services in the world, is partnering with the Stellar Development Foundation, a nonprofit organization that supports the development of Stellar, a blockchain network that facilitates crossborder transactions.

BONDEX: A GROUNDBREAKING BLOCKCHAIN-BASED NETWORK THAT REDEFINES THE FUTURE OF WORK

The way cryptocurrencies have emerged as an asset class, there is no doubt that the future of finance and many other business process solutions will be driven by revolutionary blockchain technology. Bondex, a blockchain startup, is here to disrupt an essential business process with its innovative and futuristic ecosystem. Bondex aims to play a pivotal role as a next-generation talent acquisition platform to redefine the future of work. Read more

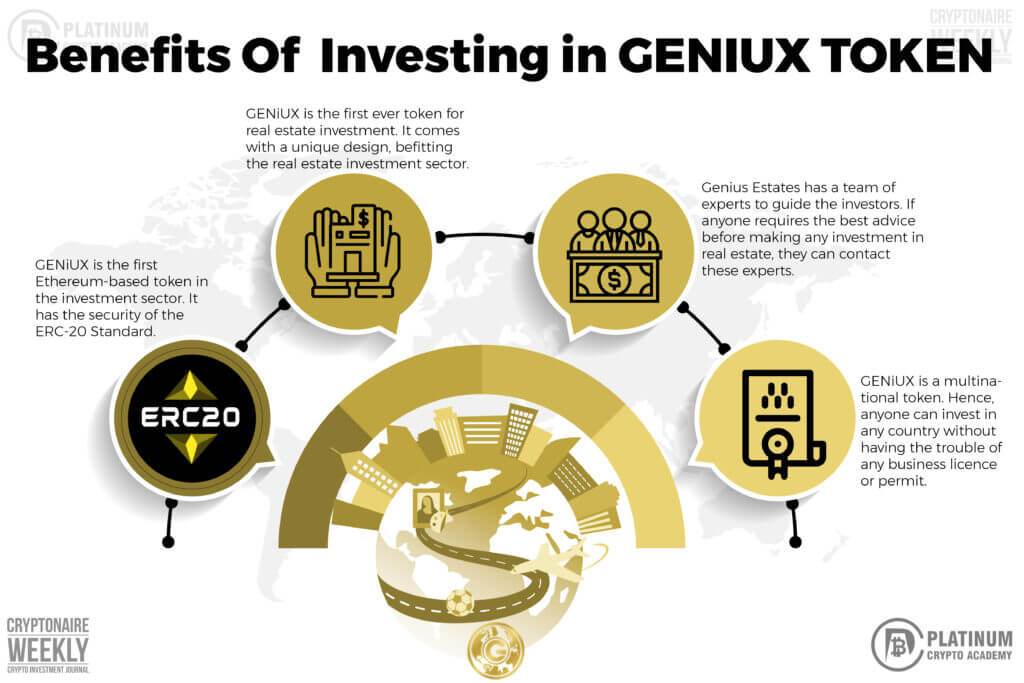

GENIUX ICO: YOUR OPPORTUNITY TO OWN A LEADING REAL ESTATE CRYPTOCURRENCY AT ITS BEST PRICE

Investment is becoming new age and modern with the introduction of cryptocurrency. Blockchain and cryptocurrency have changed everything and have opened a broad scope for small-scale investors. Tokenisation has ensured that anyone can invest in real estate without much hassle. Genius Estates is making real estate crypto investment better and more accessible with their ICO. Read more

BITCOIN DOMINATES INSTITUTIONAL CAPITAL FLOWS AS INVESTORS ACCUMULATE ETHEREUM, SOLANA AND CARDANO

D igital asset manager CoinShares says Bitcoin (BTC) is taking the lion’s share of institutional capital as sentiment in the crypto markets remains upbeat. In their weekly report, CoinShares says that the total amount of crypto assets under management (AUM) is only 5% away from setting all-time highs due to recent positive price action.makes it easy for users to spend their crypto no matter where they are in the world.

BAKKT CRYPTO EXCHANGE PARTNERS WITH GOOGLE FOR PAYMENTS

Millions of retailers currently accept Google Pay as a form of payment, potentially giving Bakkt users the ability to pay in crypto at a variety of stores and online markets. Users who hold debit cards issued by cryptocurrency exchange Bakkt will be able to convert their crypto balances to make fiat payments using Google Pay.

5 COUNTRIES WILL ACCEPT BITCOIN AS LEGAL TENDER BY END OF NEXT YEAR, SAYS BITMEX CEO

By the end of next year, at least five countries will have accepted bitcoin as legal tender, the CEO of cryptocurrency exchange Bitmex has predicted. He cited three key reasons why he arrived at this conclusion. “Developing countries will jump into crypto in 2022,” he said. More Countries Will Adopt Bitcoin as Legal Tender The CEO of cryptocurrency exchange Bitmex, Alex Hoeptner, has predicted that developing countries will lead the way in bitcoin adoption. He detailed last week:

BANK OF ENGLAND ISSUES WARNING TO FINANCIAL INSTITUTIONS THINKING OF ADOPTING CRYPTO

T he Financial Policy Committee (FPC) of the Bank of England has issued a warning to financial institutions considering jumping into the crypto markets. In the latest issue of Financial Stability in Focus, the FPC says that crypto has become increasingly integrated into the financial system as digital assets and their related markets and services continue to grow.

ETHEREUM NFT GAME SORARE INVESTIGATED BY UK GAMBLING COMMISSION

The U.K. Gambling Commission announced that it is investigating Ethereum NFT-driven fantasy soccer game, Sorare. The investigation seeks to determine whether Sorare needs a gambling license to continue operating in the United Kingdom. Sorare, an Ethereumbased fantasy soccer game built around NFT digital trading cards, has come under scrutiny by the United Kingdom’s Gambling Commission, which is investigating whether the game requires a gambling license—which it does not currently hold—to continue operating in the country.

WALL STREET MAY GET FOUR BITCOIN FUTURES ETFS IN A FEW WEEKS

The Securities and Exchange Commission (SEC) will soon make its decision on a set of Bitcoin futures exchange-traded funds (ETFs) applications that are awaiting its approval. The regulator may reject, approve or delay this month the four Bitcoin futures ETFs applications, which include the ProShares Bitcoin Strategy ETF, Invesco Bitcoin Strategy ETF, VanEck Bitcoin Strategy ETF, and Valkyrie Bitcoin Strategy ETF.

MCDONALD’S CHINA TO GIVE AWAY 188 NFTS ON 31ST ANNIVERSARY

The “Big Mac Rubik’s Cube” NFTs will be distributed to Chinese employees and customers by McDonald’s China as a part of a giveaway. Fast-food giant McDonald’s China released a set of 188 nonfungible tokens (NFT) on Oct. 8 to celebrate its 31st anniversary in the Chinese market. Branded as “Big Mac Rubik’s Cube,” the NFTs will be distributed among employees and consumers as a part of the giveaway.

BITCOIN MINER BITFURY PLANS TO GO PUBLIC WITH VALUE IN ‘BILLIONS OF POUNDS

The company is reportedly valued at around $1 billion with investors that include Mike Novogratz’s Galaxy Digital. Bitcoin mining company Bitfury is preparing to go public with what would be Europe’s biggest cryptocurrency valuation, according to The Telegraph. Bitfury is seeking advice from Deloitte over a potential public listing in the next 12 months and could have a “price tag in the billions of pounds.